Was ist eine bitcoin blockchain

Contents:

Even if a computer on the network were to make a computational mistake, the error would only be made to one copy of the blockchain. Typically, consumers pay a bank to verify a transaction, a notary to sign a document, or a minister to perform a marriage. Blockchain eliminates the need for third-party verification and, with it, their associated costs.

Business owners incur a small fee whenever they accept payments using credit cards, for example, because banks and payment processing companies have to process those transactions. Bitcoin, on the other hand, does not have a central authority and has limited transaction fees. Blockchain does not store any of its information in a central location. Instead, the blockchain is copied and spread across a network of computers. Whenever a new block is added to the blockchain, every computer on the network updates its blockchain to reflect the change.

By spreading that information across a network, rather than storing it in one central database, blockchain becomes more difficult to tamper with. If a copy of the blockchain fell into the hands of a hacker, only a single copy of the information, rather than the entire network, would be compromised.

Transactions placed through a central authority can take up to a few days to settle. If you attempt to deposit a check on Friday evening, for example, you may not actually see funds in your account until Monday morning. Whereas financial institutions operate during business hours, five days a week, blockchain is working 24 hours a day, seven days a week, and days a year. Transactions can be completed in as little as ten minutes and can be considered secure after just a few hours. This is particularly useful for cross-border trades, which usually take much longer because of time-zone issues and the fact that all parties must confirm payment processing.

As a hash is a one-way cryptographic function, the public key is not directly revealed by the address. Retrieved 30 November ZiffDavis, LLC. We examine some of the ways FS firms are using blockchain, and how we expect the blockchain technology to develop in the future. Retrieved 7 November

Although users can access details about transactions, they cannot access identifying information about the users making those transactions. It is a common misperception that blockchain networks like bitcoin are anonymous, when in fact they are only confidential. That is, when a user makes public transactions, their unique code called a public key , is recorded on the blockchain, rather than their personal information. Once a transaction is recorded, its authenticity must be verified by the blockchain network.

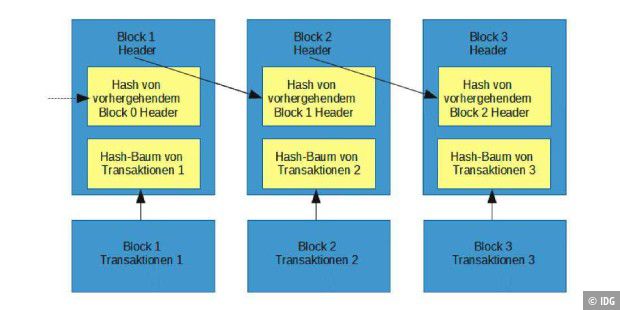

Thousands of computers on the blockchain rush to confirm that the details of the purchase are correct. After a computer has validated the transaction, it is added to the blockchain block. Each block on the blockchain contains its own unique hash, along with the unique hash of the block before it.

This discrepancy makes it extremely difficult for information on the blockchain to be changed without notice. Most blockchains are entirely open-source software. This means that anyone and everyone can view its code. This gives auditors the ability to review cryptocurrencies like Bitcoin for security. Because of this, anyone can suggest changes or upgrades to the system. If a majority of the network users agree that the new version of the code with the upgrade is sound and worthwhile then Bitcoin can be updated. Perhaps the most profound facet of blockchain and Bitcoin is the ability for anyone, regardless of ethnicity, gender, or cultural background, to use it.

According to the world bank there are nearly 2 billion adults that do not have bank accounts or any means of storing their money or wealth. These people often earn little money that is paid in physical cash. They then need to store this physical cash in hidden locations in their homes or places of living leaving them subject to robbery or unnecessary violence.

Keys to a bitcoin wallet can be stored on a piece of paper, a cheap cell phone, or even memorized if necessary. For most people, it is likely that these options are more easily hidden than a small pile of cash under a mattress. Blockchains of the future are also looking for solutions to not only be a unit of account for wealth storage, but also to store medical records, property rights, and a variety of other legal contracts.

While there are significant upsides to the blockchain, there are also significant challenges to its adoption. The roadblocks to the application of blockchain technology today are not just technical. The real challenges are political and regulatory, for the most part, to say nothing of the thousands of hours read: money of custom software design and back-end programming required to integrate blockchain to current business networks. Here are some of the challenges standing in the way of widespread blockchain adoption.

Although blockchain can save users money on transaction fees, the technology is far from free. In the real world, the power from the millions of computers on the bitcoin network is close to what Denmark consumes annually. Despite the costs of mining bitcoin, users continue to drive up their electricity bills in order to validate transactions on the blockchain. When it comes to blockchains that do not use cryptocurrency, however, miners will need to be paid or otherwise incentivized to validate transactions.

Some solutions to these issues are beginning to arise. For example, bitcoin mining farms have been set up to use solar power, excess natural gas from fracking sites, or power from wind farms.

Microsoft Launches Decentralized Identity Platform ION On Bitcoin's Blockchain

Bitcoin is a perfect case study for the possible inefficiencies of blockchain. Although other cryptocurrencies such as Ethereum perform better than bitcoin, they are still limited by blockchain. Legacy brand Visa, for context, can process 24, TPS. Solutions to this issue have been in development for years. There are currently blockchains that are boasting over 30, transactions per second.

- Main navigation.

- Bitcoin - Wikipedia.

- economist cover 1988 bitcoin.

While confidentiality on the blockchain network protects users from hacks and preserves privacy, it also allows for illegal trading and activity on the blockchain network. The website allowed users to browse the website without being tracked using the Tor browser and make illegal purchases in Bitcoin or other cryptocurrencies.

Current U. This system can be seen as both a pro and a con. It gives anyone access to financial accounts but also allows criminals to more easily transact. Many have argued that the good uses of crypto, like banking the unbanked world, outweigh the bad uses of cryptocurrency, especially when most illegal activity is still accomplished through untraceable cash. Many in the crypto space have expressed concerns about government regulation over cryptocurrencies. While it is getting increasingly difficult and near impossible to end something like Bitcoin as its decentralized network grows, governments could theoretically make it illegal to own cryptocurrencies or participate in their networks.

Over time this concern has grown smaller as large companies like PayPal begin to allow the ownership and use of cryptocurrencies on its platform. With many practical applications for the technology already being implemented and explored, blockchain is finally making a name for itself at age twenty-seven, in no small part because of bitcoin and cryptocurrency. As a buzzword on the tongue of every investor in the nation, blockchain stands to make business and government operations more accurate, efficient, secure, and cheap with fewer middlemen.

Blockchain Technology. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money. Personal Finance. Your Practice.

An analysis of the impact quantum computers might have on the Bitcoin blockchain

Popular Courses. Part Of. Blockchain Basics. Blockchain History. Blockchain and Industry.

The basics for a new user

Blockchain and the Economy. Blockchain and Banking. Blockchain ETFs. Table of Contents Expand. There is a lot of speculation about Nakamoto's real identity. Blockchain is a public ledger consisting of all transactions taken place across a peer-to-peer network. It is a data structure consisting of linked blocks of data, e.

This decentralised technology enables the participants of a peer-to-peer network to make transactions without the need of a trusted central authority and at the same time relying on cryptography to ensure the integrity of transactions. In Bitcoin, the blockchain refers to all transactions that have ever been executed in the network.