Bitcoins in money supply

Contents:

As inflationary monetary economics and liquidity traps come into focus with zero percent interest rates or even negative interest rates, many are looking to Bitcoin as an inflationary hedge or a protection against inflation. Billionaire investors are lining up to compare Bitcoin to gold.

Crypto-forgery, luring unsuspecting individuals to unsafe applications, is another issue. This effectively caused the previous block reward to become unspendable. This limited supply allows bitcoin to resist inflation. In the face of global uncertainty, buying bitcoins is a way for people to diversify their assets. Bitcoins are not paper money like dollars, euros, or yen controlled by central banks or monetary authorities.

That particular comparison has some nuances but the broad macro-theme of Bitcoin being a protection against an inflationary environment has broken through, especially after the recent halving. Why is that, and what are the historical and economic reasons we might see Bitcoin act as counter-force to inflation and what does it mean to say that it has a deflationary philosophy?

In general, inflation is a general increase of services and goods in a country over a sustained period of time. It is termed hyperinflation if the decrease in purchasing power reaches a critical inflection point where the decrease in fiat currency value and increase in prices for goods and services happens in a very rapid period of time. What might cause that decrease in fiat value? An increase in money supply, foreign investors pouring out of a particular currency, or even investors attacking a currency what George Soros did to the Bank of England , for example.

Some of these are under the direct discretion of monetary authorities, while others reflect an international flow of capital that can seldom be constrained. As a consequence, goods like food and other essentials become more unaffordable for people, as wages tend to be more fixed or static than rapidly increasing factor prices. It also becomes much more expensive to operate any business that requires raw inputs. Deflation is the opposite force.

Here, prices decrease as fiat currency increases in value relative to different goods and services. There might be different causes for this, ranging from a controlled money supply in the form of central bank restrictions or an increase in innovation. A stark example of this is technology-driven deflation, where for example, the consumer prices for compute power has exponentially decreased as technological innovation has fit more processing power into smaller chips — you can see this in how your cellphone contains more computing power than the rocket that sent astronauts to the moon or in how sequencing a human genome used to cost a million dollars in USD, and now costs sometimes less than a few thousand.

Usually, increases in inflation are correlated with decreases in unemployment, since money supply is more evenly distributed and spent among the employed, who tend to have high money multipliers. However, this is not true all the time. The s, for example, saw a period where there was increased inflation and unemployment. Inflation that comes with unemployment is part of the misery index which measures the combined sum of unemployment rate and inflation rate. When inflation increases, typically the average citizen feels the pinch, especially with their savings.

Does Bitcoin pose any threat to the Federal Reserve’s ability to conduct monetary policy?

They are incentivized to spend more in the current moment, but they get less with each passing moment for the nominal value of the money they have. This is what happened in the s in the United States, a period when gold boomed as a hedge for sliding currency value in an economy with mass unemployment.

The lockdowns have also shut down businesses that operate largely in physical spaces, leading to a mass increase in unemployment. Bitcoin is theoretically positioned as a hedge against this scenario, deriving its value from both speculative interest as a hedge, as well as its deflationary and controlled money supply and its use as a potential primary means of exchange in a more digitally-oriented world economy.

Cryptocurrencies like Bitcoin are built around those same principles as well. Today, most major global currencies are fiat. Many governments and societies have found that fiat currency is the most durable and least likely to be susceptible to deterioration or loss of value over time. Aside from the question of whether it is a store of value, a successful currency must also meet qualifications related to scarcity, divisibility, utility, transportability, durability, and counterfeitability.

Explainer: Bitcoin's mainstream charge raises stakes for central bank digital cash

Let's look at these qualities one at a time. The key to the maintenance of a currency's value is its supply. A money supply that is too large could cause prices of goods to spike, resulting in economic collapse. A money supply that is too small can also cause economic problems. Monetarism is the macroeconomic concept which aims to address the role of the money supply in the health and growth or lack thereof in an economy.

In the case of fiat currencies, most governments around the world continue to print money as a means of controlling scarcity. Many governments operate with a preset amount of inflation which serves to drive the value of the fiat currency down. In the U. Successful currencies are divisible into smaller incremental units. In order for a single currency system to function as a medium of exchange across all types of goods and values within an economy, it must have the flexibility associated with this divisibility.

The currency must be sufficiently divisible so as to accurately reflect the value of every good or service available throughout the economy. A currency must-have utility in order to be effective.

A bitcoin was worth 8, U.S. dollars as of March 4, · All the bitcoins in the world were worth roughly $ billion. · Bitcoin accounted for just % of the. However, if bitcoin gains scale and captures 15% of the global currency market (assuming all 21 million bitcoins in circulation) the total price per bitcoin would.

Individuals must be able to reliably trade units of the currency for goods and services. This is a primary reason why currencies developed in the first place: so that participants in a market could avoid having to barter directly for goods. Utility also requires that currencies be easily moved from one location to another.

Bitcoin and Inflation: Everything You Need to Know

Burdensome precious metals and commodities don't easily meet this stipulation. Currencies must be easily transferred between participants in an economy in order to be useful. In fiat currency terms, this means that units of currency must be transferable within a particular country's economy as well as between nations via exchange.

To be effective, a currency must be at least reasonably durable. Coins or notes made out of materials that can easily be mutilated, damaged, or destroyed, or which degrade over time to the point of being unusable, are not sufficient. Just as a currency must be durable, it must also be difficult to counterfeit in order to remain effective. If not, malicious parties could easily disrupt the currency system by flooding it with fake bills, thereby negatively impacting the currency's value.

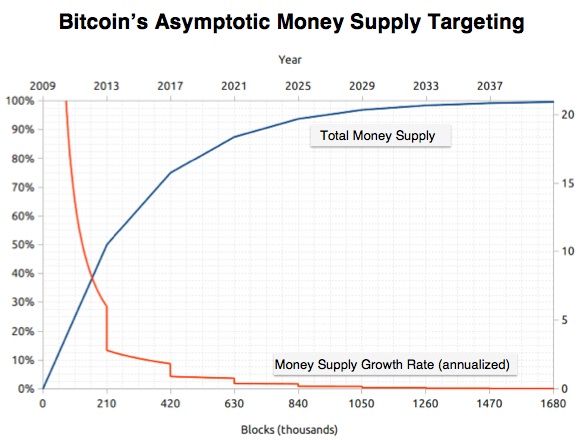

To assess Bitcoin's value as a currency, we'll compare it against fiat currencies in each of the above categories. When Bitcoin was launched in , its developer s stipulated in the protocol that the supply of tokens would be capped at 21 million. To give some context, the current supply of bitcoin is around 18 million, the rate at which Bitcoin is released decreases by half roughly every four years, and the supply should get past 19 million in the year Changing the protocol would require the concurrence of a majority of the computing power engaged in Bitcoin mining , meaning that it is unlikely.

The approach to supply that Bitcoin has adopted is different from most fiat currencies. The global fiat money supply is often thought of as broken into different buckets, M0, M1 , M2 , and M3. M1 is M0 plus demand deposits like checking accounts. M2 is M1 plus savings accounts and small time deposits known as certificates of deposit in the United States. M3 is M2 plus large time deposits and money market funds. Since M0 and M1 are readily accessible for use in commerce, we will consider these two buckets as mediums of exchange, whereas M2 and M3 will be considered as money being used as a store of value.

As part of their monetary policy, most governments maintain some flexible control over the supply of currency in circulation, making adjustments depending upon economic factors.

- The Bitcoin Central Bank's Perfect Monetary Policy | Satoshi Nakamoto Institute.

- bitcoin comment acheter!

- FURTHER READING.

- Explainer: Bitcoin's mainstream charge raises stakes for central bank digital cash | Reuters.

This is not the case with Bitcoin. So far, the continued availability of more tokens to be generated has encouraged a robust mining community, though this is liable to change significantly as the limit of 21 million coins is approached. What exactly will happen at that time is difficult to say; an analogy would be to imagine the U.

Fortunately, the last Bitcoin is not scheduled to be mined until around the year This can be seen with precious metals like gold. Notably, 21 million bitcoins are vastly smaller than the circulation of most fiat currencies in the world. Fortunately, Bitcoin is divisible up to 8 decimal points. The smallest unit, equal to 0. This allows for quadrillions of individual units of Satoshis to be distributed throughout a global economy. One bitcoin has a much larger degree of divisibility than the U. While the U. It is this extreme divisibility that makes bitcoin's scarcity possible; if bitcoin continues to gain in price over time, users with tiny fractions of a single bitcoin can still take part in everyday transactions.

One of the biggest selling points of Bitcoin has been its use of blockchain technology. Blockchain is a distributed ledger system that is decentralized and trustless, meaning that no parties participating in the Bitcoin market need to establish trust in one another in order for the system to work properly. This is possible thanks to an elaborate system of checks and verifications which is central to the maintenance of the ledger and to the mining of new Bitcoins.

Best of all, the flexibility of blockchain technology means that it has utility outside of the cryptocurrency space as well. Thanks to cryptocurrency exchanges , wallets , and other tools, Bitcoin is transferable between parties within minutes, regardless of the size of the transaction with very low costs.

The process of transferring money in the current system can take days at a time and have fees. Transferability is a hugely important aspect of any currency. While it takes vast amounts of electricity to mine Bitcoin, maintain the blockchain, and process digital transactions, individuals do not typically hold any physical representation of Bitcoin in the process. Durability is a major issue for fiat currencies in their physical form. A dollar bill, while sturdy, can still be torn, burned, or otherwise rendered unusable.