Buy local bitcoin account

An important thing to note when creating a cryptocurrency exchange account is to use safe internet practices. This includes using two-factor authentication and using a password that is unique and long, including a variety of lowercase letters, capitalized letters, special characters, and numbers. Once you have chosen an exchange, you now need to gather your personal documents. Depending on the exchange, these may include pictures of a driver's license, social security number, as well as information about your employer and source of funds.

The information you may need can depend on the region you live in and the laws within it. The process is largely the same as setting up a typical brokerage account. After the exchange has ensured your identity and legitimacy you may now connect a payment option. With the exchanges listed above, you can connect your bank account directly or you can connect a debit or credit card. While you can use a credit card to purchase cryptocurrency, it is generally something that should be avoided due to the volatility that cryptocurrencies can experience.

- btc doha;

- Bitcoin price.

- how much is my bitcoin worth;

- valor do bitcoin euro.

- 40+ ways to pay.

While Bitcoin is legal in the United States, some banks do not take too kindly to the idea and may question or even stop deposits to crypto-related sites or exchanges. While most banks do allow these deposits, it is a good idea to check to make sure that your bank allows deposits at your chosen exchange. There are varying fees for deposits via a bank account, debit, or credit card. Coinbase, for example, which is a solid exchange for beginners, has a 1. It is important to research the fees associated with each payment option to help choose an exchange or to choose which payment option works best for you.

Once you have chosen an exchange and connected a payment option you can now buy Bitcoin and other cryptocurrencies. Over recent years cryptocurrency and their exchanges have slowly become more mainstream.

Supported Countries

Exchanges have grown significantly in terms of liquidity and their breadth of features. What was once thought of as a scam or questionable has developed into something that could be considered trustworthy and legitimate. Now, cryptocurrency exchanges have gotten to a point where they have nearly the same level of features as their stock brokerage counterparts. Once you have found an exchange and connected a payment method you are ready to go.

Crypto exchanges today offer a number of order types and ways to invest. Almost all crypto exchanges offer both market and limit orders and some also offer stop-loss orders. Of the exchanges mentioned above, Kraken offers the most order types. Kraken allows for market, limit, stop-loss, stop-limit, and take-profit limit orders. Aside from a variety of order types, exchanges also offer ways to set up recurring investments allowing clients to dollar cost average into their investments of choice.

Coinbase, for example, lets users set recurring purchases for every day, week, or month. Getting an account on an exchange is really all you need to do to be able to buy Bitcoin or other cryptocurrencies, but there are some other steps to consider for more safety and security. Bitcoin and cryptocurrency wallets are a place to store digital assets more securely. Having your crypto outside of the exchange and in your personal wallet ensures that only you have control over the private key to your funds. It also gives you the ability to store funds away from an exchange and avoid the risk of your exchange getting hacked and losing your funds.

While most exchanges offer wallets for their users, security is not their primary business. We generally do not recommend using an exchange wallet for large or long-term cryptocurrency holdings. Some wallets have more features than others. Some are Bitcoin only and some offer the ability to store numerous types of altcoins.

Some wallets also offer the ability to swap one token for another.

- buy local bitcoin account;

- bitcoin exchanges liquidity.

- bitcoin fair value zero;

- bitcoin core running a full node.

- Sell bitcoins.

When it comes to choosing a Bitcoin wallet , you have a number of options. The first thing that you will need to understand about crypto wallets is the concept of hot wallets online wallets and cold wallets paper or hardware wallets. Hot wallets are wallets that run on internet-connected devices like computers, phones, or tablets.

This can create vulnerability because these wallets generate the private keys to your coins on these internet-connected devices. While a hot wallet can be very convenient in the way you are able to access and make transactions with your assets quickly, storing your private key on an internet-connected device makes it more susceptible to a hack. This may sound far-fetched, but people who are not using enough security when using these hot wallets can have their funds stolen. This is not an infrequent occurrence and it can happen in a number of ways.

As an example, boasting on a public forum like Reddit about how much Bitcoin you hold while you are using little to no security and storing it in a hot wallet would not be wise. That said, these wallets can be made to be secure so long as precautions are taken. Strong passwords, two-factor authentication, and safe internet browsing should be considered minimum requirements.

These wallets are best used for small amounts of cryptocurrency or cryptocurrency that you are actively trading on an exchange. You could liken a hot wallet to a checking account. Conventional financial wisdom would say to hold only spending money in a checking account while the bulk of your money is in savings accounts or other investment accounts. The same could be said for hot wallets.

Hot wallets encompass mobile, desktop, web, and exchange account custody wallets. As mentioned previously, exchange wallets are custodial accounts provided by the exchange. The user of this wallet type is not the holder of the private key to the cryptocurrency that is held in this wallet.

Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. To learn more, please visit our Privacy Statement. Bitbuy Popular. This is our quick guide to just one way to buy Bitcoin. Acceptance by insurance companies is based on things like occupation, health and lifestyle.

If an event were to occur where the exchange is hacked or your account becomes compromised, your funds would be lost. The simplest description of a cold wallet is a wallet that is not connected to the internet and therefore stands at a far lesser risk of being compromised. These wallets can also be referred to as offline wallets or hardware wallets. This ensures both sides hold up their end of the deal.

I've tried many peer-to-peer platforms but none are as easy and user-friendly as LocalCryptos. I have completed more than trades on this platform and expect to do many more! LocalCryptos always provides an amazing experience. It's my number 1 choice to buy and sell cryptos. The security, privacy and ease of use of LocalCryptos is incredible. In Venezuela, it's like an escape valve, and it's a powerful tool to cope with the deep economic crisis that plagues the country. LocalCryptos is well built, easy to use, and a great way to buy or sell crypto. The guys behind this are very active in the community and well respected.

LocalCryptos is a peer-to-peer marketplace. People from all walks of life place ads on LocalCryptos to buy and sell crypto. When two people agree on a sale, the buyer pays the fiat half directly to the seller—which is why LocalCryptos is so fast. LocalEthereum began in as the first peer-to-peer marketplace for Ethereum.

How to buy Bitcoin in Indonesia

After growing to more than , users, we opened the doors to Bitcoin and more. You've read the news. Exchanges have lost the password to hundreds of millions of dollars worth of Bitcoin. They collect troves of sensitive passport scans only for them to end up on the dark web and sold to identity thieves. And that doesn't include the crimes swept under the rug.

- plataforma trading bitcoin;

- Buy Bitcoin, Ethereum instantly on LocalCoinSwap.

- What Makes LocalBitcoins Different than Other Exchanges?.

- Read our beginner’s guide to buying Bitcoin (BTC) with step-by-step instructions..

- Account Options.

Crypto has earned itself a poor reputation, but it's not because of the technology. It's because Wall Street bankers have crept into the space and created a mess. When you trade on a non-custodial crypto marketplace, you are in control—not custodians, not bankers.

A decentralized escrow account holds the crypto side of the trade. This provides a guarantee of funds to the buyer, and an abort path for the seller.

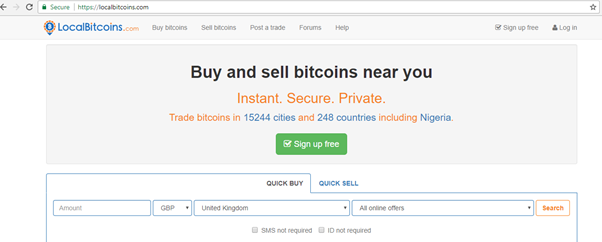

Buy and sell bitcoins near you. Fast, easy and private. Register a new account. Sign up for a user account to start buying or selling bitcoins. Username (visible to everyone)*. Email*. Password*. Your password can't.

The buyer of crypto should never send money before the crypto is in escrow. Likewise, the seller should only release the escrow after they see money in their account. If payment never arrives, either party can raise a payment dispute. This allows an arbitrator to decrypt messages, verify evidence, and get the crypto to its rightful owner. LocalCryptos is the first and largest platform to offer a decentralized, non-custodial escrow system. The technical details of the escrow depends on the crypto chosen.

All blockchains are unique. Process involved in Local Bitcoins. View Product Demo. User Login Username: [email protected] Password: view live demo. History is Boring! But numbers aren't! Talk To Our Experts. Full Name. Your Skype ID. Schedule A Meeting.