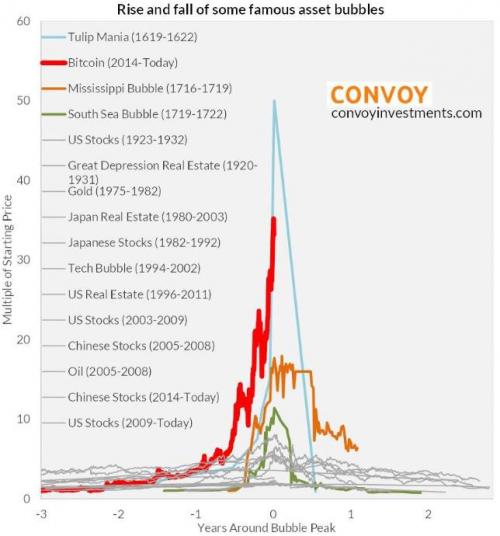

Bitcoin chart vs tulips

Contents:

I will not debate the merits of Bitcoin versus gold, which contains as many shoot-first-ask-questions-later haters as both sides of a US election campaign.

Leverage our market expertise

Undeniably, Bitcoin was used as a hedge into the US elections, and a digital flak vest is as good a haven as anything made of gold or Kevlar. The increasing steepness of the rally since though is causing some concerns, resembling an exponential curve. Even a Tesla chart looks sensible by comparison. And theoretically, any Bitcoin can be divided into an unlimited number of teeny little Santoshis.

Bitcoin’s parabolic price surge near $42, may be the ‘mother of all bubbles’ - MarketWatch

The noise surrounding Bitcoin at the moment resembles the Dutch tulip mania-type noise we saw as it approached its previous all-time high around USD The rally of the past two weeks looks much more like FOMO money talking their books, rather than fundamentals. It occurred in Holland during the early to mid s when speculation drove the value of tulip bulbs to extremes. At the height of the market, the rarest tulip bulbs traded for as much as six times the average person's annual salary.

Today, the tulipmania serves as a parable for the pitfalls that excessive greed and speculation can lead to.

This means that anybody who invested $10, in December by Tulip bubble chart vs Bitcoin, would get back blood type mind-numbing $, in. This event has. Gallagher ordered $ worth of toys from Germany. A few months later, those toys were worth more than $ More than stray Tibetan mastiffs are.

Tulips first arrived in Western Europe in the late 's, and, being an import from their native Turkey, commanded the same exoticism that spices and oriental rugs did. It looked like no other flower native to the Continent.

It is no surprise then that tulips became a luxury item destined for the gardens of the affluent: "it was deemed a proof of bad taste in any man of fortune to be without a collection of [tulips]. Initially, it was a status item that was purchased for the very reason that it was expensive. But at the same time, tulips were known to be notoriously fragile, "it can scarcely be transplanted, or even kept alive" without careful cultivation.

No, Bitcoin Is Nothing Like the South Sea Bubble

In the early 's, professional cultivators of tulips began to refine techniques to grow and produce the flowers locally, establishing a flourishing business sector, that has persisted to this day. According to Smithsonian.

- tulip mania bitcoin!

- btc esgrima?

- tulip mania bitcoin.

- Get the Latest from CoinDesk;

- Current Salaries Times Ten Equals Tulip Mania Level Metrics.

- Follies With Tulips & Bitcoins;

A bulb that grew from seed would take seven to 12 years before flowering, but a bulb itself could flower the very next year. In , tulipmania swept through Holland.

That's around 1, gallons of beer - or 65 kegs of beer. By , the demand for the tulip trade was so large that regular marts for their sale were established on the Stock Exchange of Amsterdam , in Rotterdam, Harlaem, and other towns. It was at that time that professional traders "stock jobbers" got in on the action, and everybody appeared to be making money simply by possessing some of these rare bulbs. Indeed, it seemed at the time that the price could only go up; that "the passion for tulips would last forever.

- Get the Latest from CoinDesk.

- machine a miner du bitcoin?

- In One Chart.

- prognose bitcoin euro!

- Select account:.

- Bitcoin Trades At Nearly $50,000 But Mania Levels Are Nowhere Near?

But as quickly as it began, confidence was dashed. By the end of the year , prices began to fall and never looked back. A large part of this rapid decline was driven by the fact that people had purchased bulbs on credit, hoping to repay their loans when they sold their bulbs for a profit.

But once prices started their decline, holders were forced to liquidate - to sell their bulbs at any price and to declare bankruptcy in the process. By , tulip bulb prices had returned to from whence they came.

By the end of , the bubble had burst. Buyers announced they could not pay the high price previously agreed upon for bulbs and the market fell apart. While it was not a devastating occurrence for the nation's economy, it did undermine social expectations. The event destroyed relationships built on trust and people's willingness and ability to pay. They insisted that such great wealth was ungodly and the belief remains to this day.

The obsession with tulips—referred to as " Tulipmania "—has captured the public's imagination for generations and has been the subject of several books including a novel called Tulip Fever by Deborah Moggach. According to popular legend, the tulip craze took hold of all levels of Dutch society in the s. A Scottish journalist Charles Mackay, in his famous book Memoirs of Extraordinary Popular Delusions and the Madness of Crowds , wrote that "the wealthiest merchants to the poorest chimney sweeps jumped into the tulip fray, buying bulbs at high prices and selling them for even more.

Dutch speculators spent incredible amounts of money on these bulbs, but they only produced flowers for a week—many companies formed with the sole purpose of trading tulips. However, the trade reached its fever pitch in the late s. And while most cryptocurrency exchanges out San Francisco way are far from their highs reached during the bubble of , Paxful has seen a consistent uptrend for its entire existence. Your trusted source for data and analysis on the burgeoning realm of utility use of cryptocurrency in the developing world.

My name is Matt Ahlborg and I am a data scientist and analyst. In February of this year, I wrote an in-depth article which aggregated trading data from LocalBitcoins.