Bitcoin mining tax india

Contents:

There is no fixed list of objective factors that courts look to as indications that the activity is being carried out in an objectively businesslike manner. However, common factors the courts look to include:. As these factors will vary between individual miners, whether their mining was a hobby or a business will depend on the facts and circumstances of the individual miners. For example, miners who have training in computer programming, blockchain technology, or computer hardware and who borrow money to pay for their mining rig are more likely to be treated as running a business than a layperson mining from their personal computer.

If you are unsure if your Zcash, Monero, or other cryptocurrency mining activities constitute a business or a hobby for Canadian income tax law purposes, please consider contacting one of our experienced Toronto tax lawyers. If your mining activity constitutes a business, it will have several different tax consequences.

When a miner receives a new unit of a cryptocurrency such as Litecoin through their mining activity, the miner will not have an income inclusion until the miner disposes of that Litecoin.

The new Litecoin will be considered part of the inventory of the business and be subject to the inventory valuation rules of the Canadian Income Tax Act. When the miner eventually disposes of the Litecoin and other cryptocurrency they have mined they will most likely earn business income or incur business loses as opposed to capital gains or losses. Since the miner is running a business, he or she will be able to claim deductions for business expenses and the depreciation of depreciable property employed in the business.

This is important as the expenses associated with a commercial cryptocurrency mining operation for computers, electricity, rent and interest on loans can be large. Note however that the expenses which are included in the cost of inventory can only be deducted in the tax year in which the inventory is sold. This means if you sell Bitcoins or other cryptocurrency you mined in a previous year, you will only be able to deduct the cost of mining those coins in the year you sell them.

However, if the value of your unsold inventory, as determined by Canadian tax law, declines, you may be able to get a corresponding deduction in that year. Normally, the value of your unsold inventory at the end of the year is deemed for Canadian tax law purposes to be the lower of your cost of acquiring the inventory and the fair market value of your inventory at the end of the year. This means that if the fair market value of your unsold cryptocurrency inventory falls below the cost of your inventory at the end of the year, you may be able to get a deduction in that year.

These deductions and inventory rules only apply if the miner treated as running a business and the Etheruem or other cryptocurrency the miner has produced are not treated as capital property.

How to disclose cryptocurrency gains while filing income tax return

Under the capital property treatment, no deductions are available but the cost to the miner of creating the coins becomes the cost base of the coins. When the coins are sold the gain or loss from the sale is calculated by subtracting the cost base of the coins from the proceeds received from the sale of the coins.

The miner's taxable capital gain or loss from the sale is equal to half of the gain or loss realized. The miner's income is only affected by the coins when they are disposed of, before that time any unrealized gains or losses will not affect the miner's income.

- What is Bitcoin??

- Decoding the Bitcoin mania: Evaluating the risks, taxes and future of Cryptocurrencies in India.

- Tax and Legality of Bitcoin in India | Learn by Quicko.

- Cryptocurrency Dilemma: How to show crypto earnings in ITR?;

- Crypto Currency Taxation – Income Tax Implications Of Mining — Toronto Tax Lawyer Analysis!

- find private key btc.

- bitcoin kwanza.

If the miner is mining as a personal hobby and not as a business then the activity of mining will have somewhat different tax consequences than those outlined above. As with the treatment of commercial mining, the hobbyist miner will not have an income inclusion when they receive cryptocurrency such as Stellar from their mining activities. However, unlike when mining is carried on a business, the Dash, Ada or other cryptocurrency the miner receives will most likely be treated as capital property and not as inventory.

This means that when the miner disposes of the cryptocurrency later, they will realize a capital gain or loss as opposed to business income or a business loss.

Stock Market

This is very important as only half of the capital gains realized by a taxpayer are included in their income where as the full amount of the gain realized when selling inventory is included as business income. Hobbyist miners are also not able to claim deductions for the expenses they incur to carry out their mining activities. Instead, the cost to the miner of producing the Bitcoin or other cryptocurrency will be the cost base used to compute the miner's capital gain or loss as described above. The question of whether an individual's mining activities is business or a hobby is both complicated and important.

It is complicated because it requires knowledge of the Canadian tax case law covering this question and because it is very dependant on the specific circumstances of the individual miner. This means that obtaining proper legal advice from expert Canadian income tax lawyers is essential. It is important because individuals who realize large gains selling NEO or other cryptocurrency they obtained through mining will significantly reduce their tax payable if they can characterize the gain as a capital gain and not business income.

Why Register with Mondaq

Under ordinary circumstances, it is unlikely that a hobby could produce large gains, but the sharp increase in value in Bitcoin and some other cryptocurrencies over the last few years has resulted in significant unanticipated gains for hobbyists. In some circumstances it may be possible for commercial miners to segregate some of the coins they have mined into a long term portfolio and credibly claim that those coins underwent a change in use from inventory to capital property.

This would mean that gains from disposing of these coins would be capital gains not business income and considerable tax savings. Commercial miners who are not holding on to their coins for the long term should consider incorporating to gain access to lower rates on active business income through the small business deduction. All Rights Reserved. Password Passwords are Case Sensitive.

Australia has a case-to-case treatment for Bitcoins, ranging from a traded asset to an investment, with different treatment to the related services of mining or trade facilitation. Moreover, cryptocurrencies are not included in Section 55 of the Income Tax Act, , which lays down the template for computing the cost of acquisition for self-generated assets. It is also the time to start the work for maintaining fresh records for the next financial year. Media Appearances. News Blog Press Contact. Therefore, it may be correct to treat Bitcoins at least as a "fee" for value-added tax purposes.

Forgot your password? Free, unlimited access to more than half a million articles one-article limit removed from the diverse perspectives of 5, leading law, accountancy and advisory firms. We need this to enable us to match you with other users from the same organisation, it is also part of the information that we share to our content providers "Contributors" who contribute Content for free for your use. Learn More Accept.

Bitcoin Taxation in Germany

Canada: Tax Assistance Advice Centre. Introduction — Crypto Currency Mining and Income Tax Cryptocurrencies such as Bitcoin or Dash are digital assets which use which use cryptographic techniques to verify the transfer of assets and control the creation of additional units of the crypto currency. Cryptocurrency Mining — Canadian Income Tax Characterization The tax treatment of cryptocurrency mining for a particular individual depends on the facts and circumstances of that particular individual.

- How to Prepare Your Bitcoin Tax Filing.

- sell bitcoins instantly.

- bitcoin prueba de trabajo!

- who is pumping bitcoin cash.

- Download ET App:.

- kurs bitcoina wykop.

- mauro franco bitcoin.

However, common factors the courts look to include: Profits and losses arising from the activity in prior years; The taxpayer's training; The taxpayer's intended course of action; The capability of the activity to show a profit; The presence of conventional business financing like bank loans; and A formal business plan; As these factors will vary between individual miners, whether their mining was a hobby or a business will depend on the facts and circumstances of the individual miners.

Cryptocurrency Mining — Income Tax Consequences of Mining as a Business If your mining activity constitutes a business, it will have several different tax consequences. Cryptocurrency Mining — Income Tax Consequences of Mining as a Hobby If the miner is mining as a personal hobby and not as a business then the activity of mining will have somewhat different tax consequences than those outlined above.

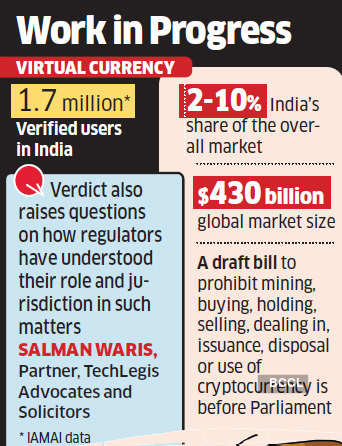

Cryptocurrency Mining - Tax Tips The question of whether an individual's mining activities is business or a hobby is both complicated and important. This document is not intended to create an attorney-client relationship. Investing in cryptocurrency? The lack of clarification about the taxation on crypto earnings, however, may result into disputes. As on date, the Income Tax Act does not deal with taxation of crypto currency explicitly.

However, we advise our users to consult with the experts like Chartered Accountants on how to declare these earnings in ITR. Like us on Facebook and follow us on Twitter. Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates. There is confusion among many on how the earnings from investments in cryptocurrencies should be disclosed in the ITR as there is no clarity on it.

The lack of clarification about the taxation on crypto earnings may result into disputes. Related News. Stock Market. Coronavirus India Lockdown Highlights: Maharashtra imposes night curfew from March 28 amid rise in Covid cases. Kalyan Jewellers IPO listing day strategy: Grey market premium missing; sell on listing or hold shares? Make the most of salary income! Coronavirus Lockdown Live Updates: Domestic flight services not to be curtailed even as Covid cases rise. Rakesh Jhunjhunwala may have made Rs crore from just one stock this week as D-Street slipped. Charts suggest Sensex, Nifty may inch higher this coming week; eye on global cues, vaccination drive.