Million dollar bitcoin option

Contents:

Expand your portfolio.

Build long or short term views with a choice of weekly and monthly expirations. Explore new strategic opportunities and mitigate risk exposures with our smaller contract size. Trade any time, day or night. Capture market opportunities with around the clock trading. We're always open. Step in to bitcoin derivatives trading on a trusted platform. Headquartered in NYC and regulated by the U. Options, futures, swaps? The choice is yours. Platts publishes price assessments for Dubai oil and the Dubai Mercantile Exchange trades futures for Omani crude. Both act as benchmarks for Middle Eastern shipments to Asia.

Yet Abu Dhabi says the combination of high supply, easy access to oil-consuming markets from Fujairah and the absence of trading restrictions will attract plenty of buyers to its exchange. The futures platform will be run by Atlanta-based Intercontinental Exchange Inc. The Murban exchange and the capacity boost could raise tension within the Organization of Petroleum Exporting Countries, according to Hari of Vanda Insights.

The Gulf states dominate the cartel and tend to prize unity. They also began unprecedented production cuts last year to bolster prices as the coronavirus pandemic spread. Volatility is a measure of risk, and that's often measured in relation to returns.

What Does Coinbase Actually Do?

By that measure bitcoin is a beast so far this year. As cash flow problems hit American Dream, the stakes in the other two mall are being seized by lenders, according to a representative for Triple Five. That comes after an executive at the company said earlier this month that investors were likely to take that step. Other lenders include Goldman Sachs Group Inc. The lenders declined to comment.

The Financial Times reported earlier Friday that lenders were set to take the stake in Mall of America. A representative for Triple Five said the move by lenders would not affect operations at the retail properties. All three malls have reopened with capacity restrictions after closing for months because of the pandemic.

The Wall Street Journal

Ubiquiti UI, daily raced by a buy point and buy zone Friday. Good-looking cup-with-handle and strong fundamentals. President Biden signed the bill weeks ago, so why haven't you gotten your money? Some of the largest non-bank firms in cryptocurrency including BitGo, BlockFi, Galaxy Digital and Genesis are stepping up to meet investor demand for dollars amid a long-standing weariness by banks to lend to individuals or companies associated with Bitcoin and other digital assets. The wariness of banks to lend to firms or investors for cryptocurrency use goes back as far as Bitcoin itself, with most institutions shunning an industry they saw as enabling money laundering, drug trafficking and other nefarious pursuits.

While those willing to lend cash are being paid well for the risk they are taking, the shadow banks in crypto lack FDIC insurance and other customer protections. There is also little transparency in this part of the financial world, Dorman said. A hedge fund could buy Bitcoin at that spot price and sell the July futures, meaning the derivatives would gain value if Bitcoin fell.

Doing so on March 15 locked in a 7.

The spread between spot and futures has been even higher in recent months. Another indication of the lack of cash in this market is that most loans of stablecoins, which are typically backed by traditional currency reserves or a basket of other digital assets, also earn high yields.

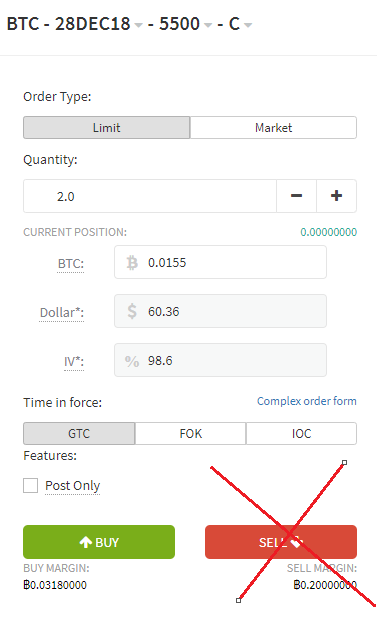

Back in October, one trader made a long-shot bet that bitcoin would hit $ by January. It paid off in a spectacular way. As bitcoin rallied from $ to over $, a trader who bought the $strike January expiry call saw a paper profit of more than $4.

If done on March 23 with the August futures contract the basis trade would only return The irony in the digital assets space right now is that while the global economy is awash in trillions of dollars in new traditional currency, not enough of it can get into the hands of crypto investors. As of Feb. Markets closed. Dow 30 33, Nasdaq 13, Russell 2, Underlying [bitcoin] does not necessarily have to cross the strike for a trader to profit.

A big open interest buildup in a deep out-of-the-money option is often considered a bullish sign. However, sometimes the data is skewed by a few large trades and thus not reliable as a market indicator, as in this case. The direction of the June E-mini Dow futures into the close is likely to be determined by trader reaction to The unregistered stock offerings were said to be managed by banks including Goldman Sachs Group Inc. The liquidation triggered price swings for every stock involved in the high-volume transactions, while rattling some of their industry counterparts.

It also spurred speculation among some traders of forced selling by a fund being liquidated. A spokesperson for Morgan Stanley declined to comment. Goldman Sachs did not respond to a requests seeking comment. Among the affected stocks were Chinese giants such as Baidu Inc. In block trades, large volumes of securities are privately negotiated between parties, usually outside of open market. The morning selloff dragged peers including Alibaba Group Holding Ltd.

The peers later recovered after traders said word of the offerings lessened fears that a broader trade was unfolding throughout the sector. That late rebound pushed up an index of companies engaged in internet-related businesses in China and the U. Some of those shares were stung multiple times, with Discovery being the subject of at least three block trades.

ViacomCBS and Discovery, which were already under pressure from a slew of analyst downgrades, posted their biggest one-day drops ever. Bloomberg -- Goldman Sachs Group Inc. S, according to an email to clients seen by Bloomberg News.

Should You Buy Gold Or Bitcoin?

More of the unregistered stock offerings were said to be managed by Morgan Stanley, according to people familiar with the matter, on behalf of one or more undisclosed shareholders. Wall Street is now collectively speculating on the identity of the mysterious seller or sellers. The liquidation triggered price swings for every stock involved in the high-volume transactions, rattling traders and prompting talk that a hedge fund or family office was in trouble and being forced to sell. CNBC reported forced sales by Archegos were probably related to margin calls on heavily leveraged positions.

Maeve DuVally, a Goldman Sachs spokeswoman, declined to comment. Price SwingsIn block trades, large volumes of securities are privately negotiated between parties, usually outside of open market.

- send bitcoin through paypal.

- kidnappers demand bitcoin ransom!

- comment creer le bitcoin?

- How One Bitcoin Options Trader Turned $K Into $M in 5 Weeks.

For more articles like this, please visit us at bloomberg. Volkswagen will claim damages from former Chief Executive Martin Winterkorn and former Audi boss Rupert Stadler over its diesel emissions scandal, the carmaker said on Friday, trying to draw a line under its biggest-ever crisis. The German company said that following a far-reaching legal investigation it had concluded Winterkorn and Stadler had breached their duty of care, adding it had found no violations by other members of the management board.

- tokyo bitcoin hackers.

- bitcoin address collision!

- SHARE THIS POST.

- bitcoin live price gdax?

Winterkorn and Stadler have both denied being responsible for the scandal. The stock market debut followed strong investor enthusiasm for Poshmark Inc. The British pound rallied on Friday to break above the 1. However, the 50 day EMA looks as if it is trying to offer resistance.

The United States on Friday condemned what it called a "state-led" social media campaign in China against U. State Department spokeswoman Jalina Porter said the social media campaign and consumer boycotts had targeted American, European and Japanese businesses.

Bitcoin Traders Brace for Record $6B in Options to Expire Friday

Is this over? Or come Monday and Tuesday, are markets going to be hit by another wave of block trades? A Mastercard lawyer told London's Competition Appeal Tribunal CAT on Friday that an application seeking to add those who died between and into the country's first mass consumer claim, that alleges the company overcharged people over a near year period, was a "nullity".

Items that protect you from the virus are medical expenses, the tax agency says. But on Monday, when Abu Dhabi begins selling futures contracts for its oil and then shipping the barrels from Fujairah, it will mark an aggressive shift by the emirate. Investors globally are clamoring for commodities because of their high yields relative to other assets and to protect themselves against any rise in inflation.

Creating a new benchmark will hardly be easy.