Plus500 bitcoin wallet

Contents:

Generally, the processing time for a withdrawal request is one business day. Depending on the processing time of your payment provider or bank, funds will be credited to your account.

- john lewis btc light.

- bitcoin capitalization chart.

- Plus Bitcoin (PlusBitcoin) - Profile | Pinterest!

An Overnight Funding fee explained below might be applicable, depending on your trading activity. The overnight funding amount will be added to or subtracted from your account when holding a position after a certain time in the day. The fee varies depending on the cryptocurrency chosen. However, the fee will be deducted only if there are sufficient funds available in the account. Plus offers a fixed or dynamic spread for its instruments. The calculation of spread can be done by subtracting the relevant selling price from the buying price of the chosen instrument.

The dynamic spread can change during the period in which a position is open, whereas a fixed spread remains unchanged from the moment you open the position until the moment you close it. Spread fees for individual tokens can also be found on the Plus Instruments page. This section has other useful information , including initial margin, maintenance margin, leverage and, as previously mentioned, the overnight funding fee. If you are making international credit card transactions and using a currency that is not supported by the platform, then a conversion fee may be applicable.

In this case, the conversion fee will be determined by your payment provider or bank , and not by Plus Visit Plus For trading cryptocurrency CFDs, your account balance should be greater than or equal to the initial margin which is calculated using the following formula:. Initial margin percentage for cryptocurrency CFDs is fixed at The leverage offered by Plus for all cryptocurrency CFDs is In addition to this, users can also be notified if a login is attempted from a new device.

Alternatively, you can send a message to their WhatsApp number, and you will probably get a much quicker response. For general queries, users can refer to the articles listed on the FAQs section of the website. Both platforms offer trading in CFDs for a wide selection of cryptocurrencies like Bitcoin, Ethereum, Litecoin, as well as other markets. In addition, eToro lets you buy a handful of cryptocurrency assets whilst Plus offers solely CFDs. Both Plus and AvaTrade allow users to trade on the go with their mobile apps.

When compared to AvaTrade , Plus supports a larger number of instruments including shares, commodities, and cryptocurrencies. Providing a combination of educational support and detailed charting tools, the platform is ideal for both novice and experienced traders. Since it is regulated, users can be assured that their details and funds are duly protected and secured. Nevertheless, trading CFDs is still considered to be a high-risk investment, especially when using leverage.

There are several different ways to make money on Plus Check out our guide to see how you can profit by using the platform. To terminate your Plus account you will need to get in touch with customer care. Plus does not charge any commission on trades, with the main fee being the spread. You should consider whether you can afford to take the high risk of losing your money.

Recommended Exchanges. Try Plus Jump to page contents. Plus Platform Review Plus is one of the leading trading platforms specialising in Contracts for Difference. Overnight Funding The overnight funding amount will be added to or subtracted from your account when holding a position after a certain time in the day.

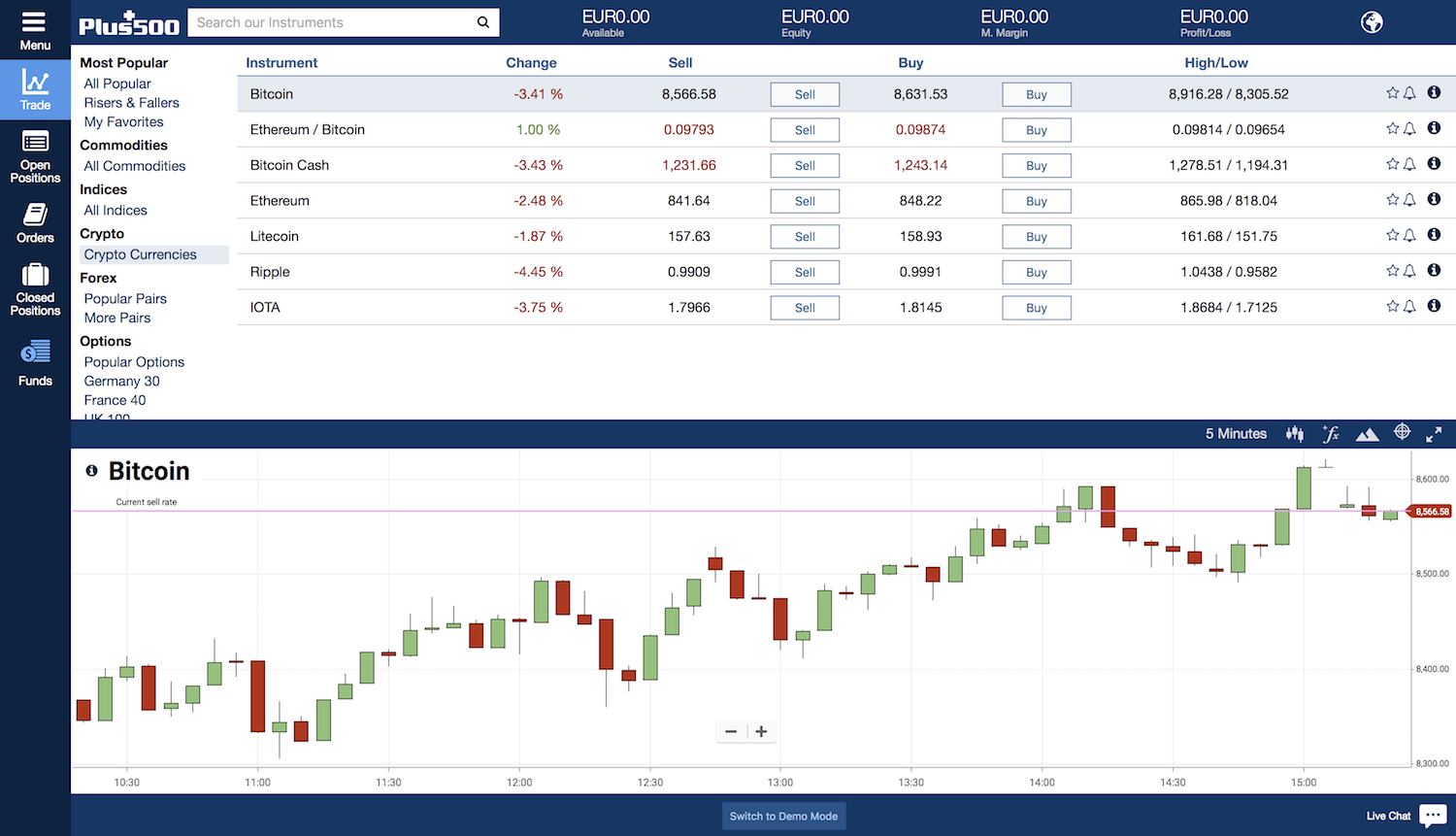

Spread Fee Plus offers a fixed or dynamic spread for its instruments. Screenshots are shown for illustration purposes only. Actual product may vary. How can I make more money on Plus? How can I delete my account on Plus? What is the required margin on Plus? How much money do you start with on Plus? How much commission does Plus take? Normally, for higher limits on Bitcoin exchanges, the buyer is required to provide bank account details, while debit cards can be used for lower limits on transactions. Using Bitcoin exchanges may be somewhat more long-winded in terms of completing all of the necessary details, but the transaction fees are much more competitive and would be the best way forward.

Also, you can rate the customer support agent instantly after the conversation ends, which is again a good way to share your feedback and help them improve in case of any lacking. Furthermore Plus has no trading fees you have to deal with. Post your question. Read more about different accounts at Plus below. The platform is facilitating traders from a structured regulatory framework utilising multiple regulatory frameworks which is why traders consider this brokerage service reliable and trustworthy for their deposits. You can trade many different cryptocurrencies, stocks, forex, commodities, options, ETFs, and indexes. It is possible to make money with Plus as

IO — This exchange provides buying and selling of Bitcoins as well as other cryptocurrencies. These are the steps that one must follow in order to purchase Bitcoin via CEX. A digital wallet is where you hold your cryptocurrencies and interacts others via the blockchain technology.

There are many providers of digital wallets, however, it is important to make a deep research before you decide which one is the best for you. Currently, the most popular digital wallets provider is Blockchain. Once you enter CEX. IO website , register and open an account that can provide you with their service. This is the authentication code as well as your password when you access CEX. The code will be generated by an application and will be delivered to you by SMS.

Now you can easily purchase Bitcoin and other cryptocurrencies.

What is Bitcoin?

Note that you can always buy fractions of Bitcoin and CEX. IO allows you to choose fixed amounts with your own currency. In order to complete the purchase, the broker will ask you to verify your identity with documents and various details. Bitstamp — They make buying and selling easy, requiring those looking to buy Bitcoin to simply create an account, make a fiat currency deposit via SEPA wire transfer or other deposit method and then simply purchase Bitcoins once the funds have reached the newly created account.

Coinfloor — This exchange is said to have become the largest exchange for Bitcoin to Sterling exchanges and is considered to be the first publicly auditable Bitcoin exchange, with an emphasis security on its website.

- Plus review → Is this broker safe to trade crypto??

- How does bitcoin trading work with Plus500?.

- difference bitcoin cash.

CoinCorner — Allows the use of 3D secure enabled credit to immediately purchase Bitcoins, debit cards to deposit funds into an account for the purchase of Bitcoins or currency deposits made by SEPA bank transfers. Coinbase — Supports 32 countries with more than 10m customers served and allows the purchase of Bitcoin for UK buyers using 3D secure enabled credit and debit cards.

There are others and it does require some amount of research to find the best exchange that addresses buy and seller requirements on fees, security, etc. Exchanges will also provide a number of enticing offers including bonuses, so it is worth having a look at the exchanges to see which are the most competitive, though it would be advisable to sign up with a reputable one. If the sound of a Bitcoin exchange is off-putting, the alternative is to buy and sell Bitcoins via a Bitcoin ATMs, though most will only accept cash for a purchase, or face-to-face.

The popularity of Bitcoin trading has certainly surged in recent years, with more traders entering the market each day as concerns over Bitcoin being a bubble ready to pop continues to ease over time. Volatility in Bitcoin has enticed traders from the more traditional markets, with the setup of trading platforms through Bitcoin exchanges facilitating the trading of Bitcoin and other cryptocurrencies. Bitcoin exchanges provide the liquidity and the platform for trading, with the spreads between bid and ask prices narrow enough for traders to make tidy profits on a daily basis, as long as they are on the right side of a trade.

Bitcoin exchanges also offer OTC markets and favorable fees to draw in traders the world over. With a large number of Bitcoin exchanges now in existence, traders will look for exchanges that provide the most favorable fees, whilst also provide the appropriate security levels needed for such a digital currency.

Today, exchanges provide traders with the opportunity to go both long and short on trades through investing into CFDs, removing the need to hold Bitcoin wallets and Bitcoin itself, with margins also on offer. The larger exchanges offer up to 20x leverage. The price comparison is a key consideration as well as fees. Some exchanges provide traders with no fees for daily trading, but with UK banks having issues with Bitcoin exchanges, the time taken for wire transfers to reach exchange accounts for purchases and for sales proceeds to reach the trader is also issues faced by the UK Trader.

Plus : They have a wide variety of cryptocurrencies that can be exchanged via a convenient platform. Plus provides the contract for differences which allows trading without physically owning an instrument. The broker support Bitcoin gold, Bitcoin Cash, etc. COM : No commission and no withdrawal fees, with the ability to trade CFDs as important to the trader for short positions. FXTM : Providing traders with cryptocurrencies trading with low spreads and minimum commission. For those looking to get a sense of how widely accepted Bitcoin is in the UK, WheretospendbitcoinsUK is a good place to start and the site offers search functionalities to those looking to use Bitcoin to purchase particular goods or services across the country.

As the Bitcoin world has evolved, so have the different platforms on offer for those looking to buy and sell Bitcoin. While Bitcoin exchanges are the most secure platform for transactions, Bitcoin ATMs have been on the rise globally.

Bitcoin trading at Plus500

Unlike traditional ATMs linked to the centralized banking networks, Bitcoin ATMs are there to simply facilitate the buying and in some cases the selling of Bitcoins. Bitcoin ATMs have increased in popularity as they continue to provide buyers and sellers with the anonymity that so many require.

For the privilege of anonymity, Bitcoin ATM transactions come with significantly higher fees than on Bitcoin exchanges and there are also limits on the size of transactions. On a global basis, the average fee for a buy order is 8.

For many, the distances will certainly too great to travel in order to buy or sell Bitcoin, which would leave buying and selling via an exchange or on sites such as LocalBitcoin. While UK banks may be unwilling to provide the necessary services for Bitcoin exchanges today, times are likely to change. Bitcoin is becoming more widely accepted across the country and has garnered significant interest from both those looking for a long-term investment and those looking to trade on the volatility.

The funds are then transferred from this wallet to the wallet provided by the crypto exchange for depositing that cryptocurrency. If you choose to use this method. Bitcoin | BTCUSD Trading - Open Buy or Sell positions on Cryptocurrency CFDs. Crypto trading with Bitcoin | Litecoin | Ethereum, Ripple XRP and more.

The UK market is in need of an upgrade to facilitate buying and selling, with face-to-face transactions the best option for those looking to hold a small number of Bitcoins and not have to deal with the impact of exchange rates and fees akin to Bitcoin exchanges. We will expect the upgrade to happen, however, though the UK government will need to follow its Asian peers into accepting Bitcoin. As is the case in other jurisdictions, those looking for anonymity pay the price, with fees considerably higher when buying and selling Bitcoin using Bitcoin ATMs or face-to-face platforms such as LocalBitcoin.

Crypto Hub. Economic News.