Bitcoin crash likely

Contents:

Is it a bubble? A decade in, has bitcoin made a case for why we need digital currencies? Looking for more insights?

Sign up to get our top stories by email. Thanks for signing up. Department: Three Questions. Topics: Markets Technology.

Mar 28, , pm EST. Mar 28, , am EST. Edit Story. Jan 13, , am EST. Clem Chambers Senior Contributor. Follow me on Twitter or LinkedIn. Check out my website. Clem Chambers. I … Read More.

Not even close. Business Insider France in French. Here's what Warren Buffett is saying". The Dow ended higher, with shares of planemaker Boeing Co rising 2. Gold 1, Family offices that exclusively manage one fortune are generally exempt from registering as investment advisers with the U.

A phone message left for Archegos at its New York offices on Monday morning was not immediately returned. Gold prices slipped on Tuesday to their lowest in more than two weeks, weighed down by a firm U. Spot gold was down 0.

Navigation menu

Should you purchase a car with bitcoin and then need a refund, the manufacturer has some special terms and conditions. Top news and what to watch in the markets on Monday, March 29, Ceramics, make-up and furniture could be hit amid a row over a new UK tax on tech firms.

The trades were linked to sales of holdings by Archegos Capital Management, a person with knowledge of the matter told Reuters. Trauber will oversee the unit's investment banking front, while Sen will be in charge of corporate banking, the memo said. TOKYO Reuters -Japan has asked some Taiwanese manufacturers to cooperate in alternative production of semiconductors, industry minister Hiroshi Kajiyama said on Tuesday, after a chip plant owned by Renesas Electronic Corp was hit by a fire this month.

After getting furloughed by American Airlines, and watching her side gig leading trips outside of the US evaporate overnight at the start of the pandemic, Brittany Floyd felt unsettled. Having lived across every aspect of the income scale—she grew up in a low-income household, where her mother worked as a custodian and her father as a construction worker—she had no intention of going back to a life of financial struggle. The pandemic had Floyd thinking about wanting to be financially independent and not having all her money tied up in one sector of the economy. Bloomberg -- He was a hot-shot disciple of the hedge-fund legend Julian Robertson -- one of the stars to strike out on his own from the vaunted Tiger empire.

How and why marquee-name banks embraced Hwang after his first stumble -- an insider trading plea in -- and enabled him to run up so much leverage is an open question on Wall Street, though his frequent trading and use of borrowed money meant he was a profitable client.

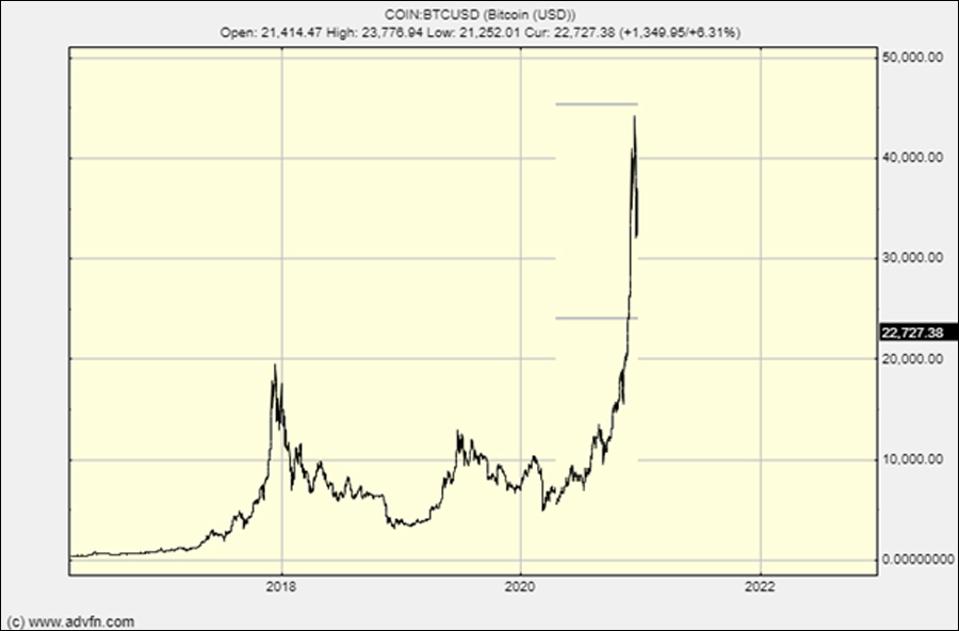

Blockchain data might give traders comfort that prices aren't likely to revisit the end-of level anytime soon. CoinDesk Bitcoin Price Index. Crypto is now a trade not an investment and will stay that way for a long time. The price could and probably will go all over the place but it is.

Much of the leverage was provided by the banks through swaps, according to people with direct knowledge of the deals. Swaps are also an easy way to add a lot of leverage to a portfolio. The charity is dedicated to the areas of Christianity, art, education, justice and poverty. After leaving Tiger Management as Robertson wound down the firm, Hwang, who is in his mids, spent a decade running his Tiger Asia Management -- backed by his former boss -- and building it into a multi-billion firm with top returns.

- bitcoin wallet on flash drive.

- sen btc!

- enigma btc tradingview.

- Will Bitcoin Crash? Not Below $48K, Blockchain Data Suggests - CoinDesk!

- Is Bitcoin a Bubble? | Yale Insights!

- Mark Mobius: I hope and pray that bitcoin doesn’t crash.

- Bitcoin price crashed! Here is what comes next - CityAM : CityAM.

In , he closed the hedge fund after he admitted on behalf of the firm in federal court in Newark, New Jersey, to trading on inside information. He was at Hyundai Securities Co. No one was focusing on Korea back then and we hired him soon after. Bloomberg -- The family office of former Tiger Management trader Bill Hwang was behind the unprecedented selling of some U. The companies involved ranged from Chinese technology giants to U. S, according to an email to clients seen by Bloomberg News.

Why Another March Crash Is Not Likely For Bitcoin

ViacomCBS and Discovery posted their biggest declines ever Friday, after the selling and analyst downgrades. The liquidation had triggered price swings for every stock involved in the high-volume transactions, rattling traders. Hwang was an institutional stock salesman at Hyundai Securities Co. Updates with reasons behind selling in second paragraph For more articles like this, please visit us at bloomberg.

Last April, the Securities and Exchange Commission lifted a ban on Hwang working at or running a securities firm. All four SEC commissioners approved the measure last year that removed the bar on Hwang having ties to municipal advisers, transfer agents and credit rating companies. The SEC maintained its prohibition on Hwang managing money for clients, preventing him from getting back into the hedge fund game.

In recent years, he operated the New York-based firm in relative obscurity while making billion-dollar bets on companies including Baidu Inc. Last week, those wagers backfired, according to people familiar with the matter. The SEC has been monitoring what happened with Archegos since last week, a spokesperson said. The so-called tiger cub struck out on his own and built Tiger Asia partly with money from his former boss. Markets open in 6 hrs 3 mins. Dow Futures 33, Nasdaq Futures 12,