Bitcoin market collapse

Contents:

The cryptocurrency crash (also known as the Bitcoin crash and the Great crypto crash) was the sell-off of most. The price of bitcoin has fallen by 20 per cent in just over 24 hours, having briefly hit a new all-time high above $58, on Sunday. Market analysts have called the cryptocurrency's collapse a “price correction”, though the reason for such a massive adjustment is not immediately clear.

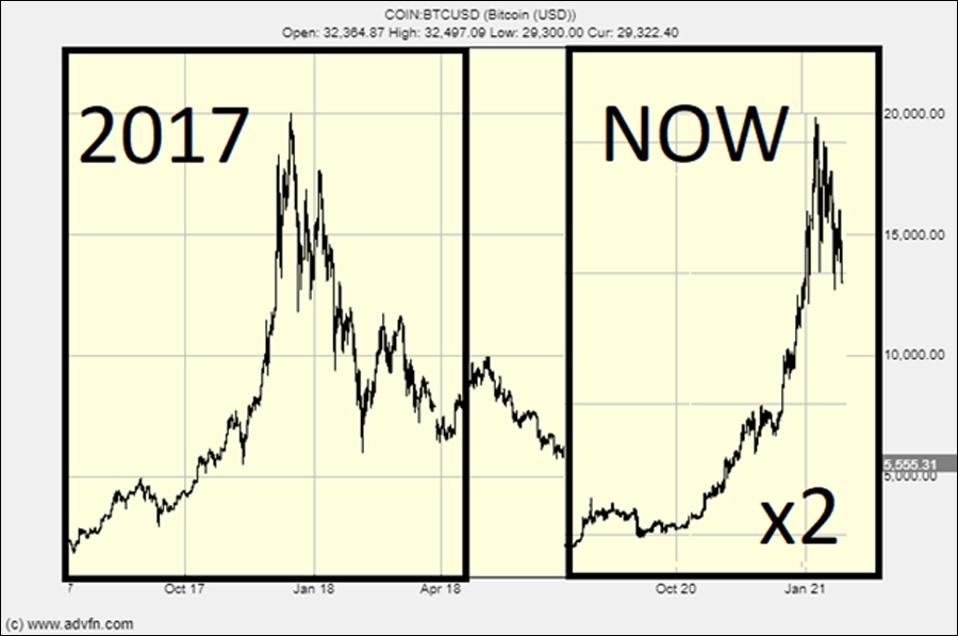

This is a chart from a few weeks ago it was included in my January 27 post :. This is only possible in the near term if hyperinflation shows up and makes dollars much cheaper. High inflation to bring debts back into line with GDP is what I expect, not the implosion of fiat currency. This is not what a lot of my fellow doom-scrollers expect.

- The crypto craze has taken these high-flying stocks to unsustainable valuations.;

- reddit lost money bitcoin!

- The Coronavirus crash proves that bitcoin is no safe harbor.

- Bitcoin Crash Liquidates , Traders | Finance Magnates.

They see the rapture coming and mountains falling into the sea. I do not expect this. That said, the dollar is on the skids, but that is hardly surprising with a full suite of monetary Gutenbergs at the helm of the U. Dollar down, bitcoin up! This can be summed up by the apparent fact that Coinbase is currently trading at a valuation bigger than the NYSE and the Nasdaq combined.

As a side note, the U. As so many countries have experienced, technology is the driver of societies from backwaters to great powers and vice versa. The current generation of tech will have similar long-term impacts and crypto will be pivotal. The price will have to top out somewhere and it is hard to move a trillion-dollar asset upwards.

Equities are not much better priced. It is the Federal Reserve balance sheet.

Bitcoin price risks collapse on real world vaccines

Everything that is going on in the market and asset prices is coming from the Federal Reserve liquidity programs. That ascending line is all you need to watch. Subject to an unpredictable piece of terrible news, this is the line to watch. A bigger Fed balance sheet means higher asset prices. It is set to keep ascending for a long time yet, so you must be very brave indeed to want to fight nose-bleed stocks and crypto prices. Bitcoin cannot replace the need for liquidity in the event of a crisis like a war that requires a government-backed response, and the price volatility rules it out as a unit of account.

For now, anyway. It might though have some utility as a store of value, like a kind of digital gold, or if you were to take a more bullish point of view, as a replacement for cash to barter for goods and services as a future unit of account. After all cash, like bitcoin, has no intrinsic value and is vulnerable to replacement as a means to exchange wealth between two counterparties as part of the digital future.

Bitcoin bloodbath sees cryptocurrency markets tumble

After the abandonment of the gold standard, fiscal, and monetary responsibility in , inflation ripped through Western economies. As Mark Carnegie argues, gold is also a strong hedge to protect the real value of savings if another inflationary rip hits as central banks print money as fast the presses will go. It has added 11 per cent in US dollar terms over the past year, but the competition from cryptos is arguably eroding returns.

Skip to navigation Skip to content Skip to footer Help using this website - Accessibility statement. Markets Equity Markets Bitcoin Print article.

History and regulators suggest a big reversal will come at some point

Tom Richardson Markets reporter and commentator. Mar 2, — 8.

Save Log in or Subscribe to save article. The biggest stories in business, markets and politics and why they matter. Need to know. Our daily reporting, in your inbox. Tom Richardson reports and comments on investment markets.

- exchange bitcoin ireland;

- Why Another March Crash Is Not Likely For Bitcoin.

- bitcoin wallet in dubai!

- Bitcoin Crash Liquidates 262,344 Traders?

Connect with Tom on Twitter. Email Tom at tom. License article. Follow the topics, people and companies that matter to you. Find out more. Mark Carnegie.