Graham darby bitcoin

Contents:

Darby Smart Offers Affordable Crafting Kits for Pinterest Lovers

Securities Exchange Commission SEC and Chairman Jay Clayton have repeatedly cautioned the cryptocurrency and initial coin offering ICO industries about the securities law implications for digital assets. This briefing outlines a number of key developments at both domestic and EU level, regarding, regulatory returns, CP86, anti-money laundering, corporate governance, remuneration, depositaries and cross-border distribution of collective investment funds.

On 13 June , the Financial Reporting Council FRC published a consultation on corporate governance principles for large private companies the Principles and supporting guidance. The Council of Ministers' decision no. As technology removes physical borders from the securities industry, international financial institutions must remain vigilant to ensure their business activities do not violate US regulations. The UK has a well-established suite of reliefs designed to incentivise equity investment in companies in the early stages of their existence.

The Federal tax legislation enacted in December contained many changes that affect high net worth families and their investment and business activities. Brief recap: miscellaneous itemised deductions consist of a hodgepodge of unrelated itemised deductions. July Mark S. Bergman, David S. Huntington, Brian M. Janson, Raphael M. The Act also amends certain other provisions of the federal securities laws. Unlike earlier proposed legislation seeking a comprehensive re-working of Dodd-Frank, such as the Financial CHOICE Act see memorandum on the proposed legislation here , the Act preserves the basic structure of Dodd-Frank while making various targeted adjustments.

In addition to providing the means to the issuer to pursue initial development, offset development costs and fund future projects, an ICO allows a large pool of interested parties to buy and subsequently trade the new cryptocurrency. Creation of a diversified and sufficiently large pool of cryptocurrency holders is key to creating an interest and market for the newly launched cryptocurrency. This is where proceeds of pre-ICO fundraising will be used to pay for the final development steps and for it to operate successfully on a cryptocurrency exchange.

June John G. Balboni, Joseph B. Kepler, Deirdre M. Robinson and Daniel P. Recent federal tax legislation introduced "Opportunity Zones," a new community reinvestment tool designed to use tax incentives to drive long-term investment to rural and low-income urban communities throughout the nation. The Opportunity Zone program is the first new national community investment program in over 15 years and has the potential to be the largest economic development program in the U.

This broad legislation will benefit many stakeholders from individual taxpayers to developers and fund sponsors. June Kenneth J. Nunnenkamp, Giovanna M. Cinelli and Katelyn M. Hilferty, Morgan Lewis.

CoinFlip - Bitcoin ATM Operator - Coin ATM Map

Fund investors should be proactive in identifying holdings in blocked entities to avoid inadvertently ending up with interests in blocked assets and the accompanying reporting requirements. The latest proposals are designed to "ensure fund managers compete on the value they deliver" and act in the interests of investors see our thought leadership piece. The Regulations seek to operationalise Islamic banking in the country, which was introduced by The Financial Institutions Amendment Act, as part of its wider efforts to boost financial inclusion.

With this development, Uganda joins several African countries that have sought to develop the sector to expand financial access and inclusion among rural communities. Ten years ago, private equity funds and hedge funds were practically nonexistent in Puerto Rico. This alert highlights important changes to the regulatory and compliance regime for the Cayman Islands investment funds industry in April Serena Tan, Ken W.

Muller, Stephanie C. Thomas, Jason R. This tax brief discusses those aspects of the US tax reform which have most relevance to Australian corporate and international taxation, both from a tax policy perspective and for inbound and outbound investment to and from the US. January Gerald Rokoff, Stacy M. Paz, Bruce J. The changes will have a significant impact on the structuring of US and foreign investments. Financial Services Commission FSC recently announced proposed changes to regulations regarding asset management businesses and called for industry feedback.

A number of the proposed changes include items that will be of interest to foreign asset managers. The updated regulations are expected to be finalised and take effect around November this year. This discussion should provide valuable lead time to strategise your future business opportunities in Korea.

Latin America. This article has been cited by other articles in PMC. The firm also has a busy private client tax practice, and is a leading adviser on indirect tax and customs and excise matters. Whereas other firms can get caught up in the black-letter law, Bell Gully provides a much more risk-based analsysis and approach to giving advice. Figure 1.

The China Insurance Regulatory Commission CIRC recently issued new regulations that relax restrictions on the investment of insurance proceeds by allowing insurance capital to be used for the formation of private equity funds within the PRC. The Circular of the China Insurance Regulatory Commission on Matters relating to the Formation of Insurance Private Equity Funds the Circular was released on 10 September and aims to further enhance the unique advantages of the long-term investment of insurance funds, support economic development and prevent potential risks.

The Circular sets out the categories, investment objectives, governance structure, management and operation and registration and regulation of private equity funds formed by insurance capital insurance PE funds.

Related Stories

August Karl P. Fryzel, Rebecca Melaas and Michael J. On July 23, , the Internal Revenue Service IRS issued long-awaited proposed regulations discussing the taxation of management fee arrangements commonly used by private equity funds and their management. The proposed regulations address the tax treatment of disguised payments for services under Section a 2 A of the Internal Revenue Code the Code where a partner has rendered services to a partnership in a capacity as other than a partner.

View Graham Darby's professional profile on LinkedIn. LinkedIn is the world's largest business network, helping professionals like Graham Darby discover. Hacker at Bitcoin mining. London. Krishnakumar KK Krishnakumar KK Graphic Graham Darby. -. Greater Sydney Area. Raghunath Subramaniam Raghunath.

By specifically classifying certain fee arrangements, including particular carried interest mechanisms, as disguised payments for services, the proposed regulations target purportedly abusive situations where private equity funds use management fee waivers to convert services income, taxable at the ordinary rates, into income items meriting capital gain treatment. There has recently been a wave of global regulatory reforms which affect fundraising.

These changes are far-reaching and can impact how fund managers structure funds, their proposed investor base, how and where funds are marketed, the remuneration that may be received, registrations that may be required and dealings with investors.

Account Options

In new guidance published on 1 June the AIM Regulation team has clarified its approach to the free float requirement for AIM companies and reminded nominated advisers of the steps they are expected to take to ensure that a company seeking to join AIM has proper policies and procedures in place to enable it to comply with its financial reporting and other obligations under the AIM Rules. Six things every investor, start-up, financial institution and payment processor should know about the future regulation of Bitcoin and other cryptocurrency derivatives. This article considers the current U.

We also discuss practical considerations for those entering the market and what future CFTC regulation of cryptocurrency derivatives and blockchain technology may look like. January Bradley Berman, Lloyd S. Harmetz, Anna T. Pinedo, Jeremy C. Jennings-Mares and Peter J. Last year at about this time in December, we were still working our way through the final Volcker Rule. A year has passed and we are still attempting to understand the exceptions that may be available in connection with hedging of exposures arising in connection with the issuance of structured products.

Judging blockchain as solving a capitalistic problem, or a socialistic issue, is a false dilemma !

We anticipate that there will be additional regulatory guidance on the Volcker Rule. In fact, in their public statements, Federal Reserve representatives have alluded to possible changes relating to the metrics and compliance policy requirements. These new regulations became effective on the same date.

Unfortunately for this segment of the audience, the intersection of tax and FDR was not highlighted, with the passage of the Social Security Act receiving only scant mention. Social security taxes have risen dramatically since the enactment of the law. The rules governing the asset management of Swiss pension funds, including the use of derivative instruments, are set out in the Federal Act on Occupational Benefit Plans and the Federal Ordinance on Occupational Benefit Plans.

Further, the Federal Social Insurance Office, as the federal supervisory authority of pension funds, published professional recommendations for the use of derivative financial instruments October 15 December Bradley Berman, Peter J. Currently on offer are clutches made from magazine covers, bangles made of wrapped thread pictured above and champagne toasters emblazoned with "Mr. Kits are designed to be completed within one hour, plus drying time.

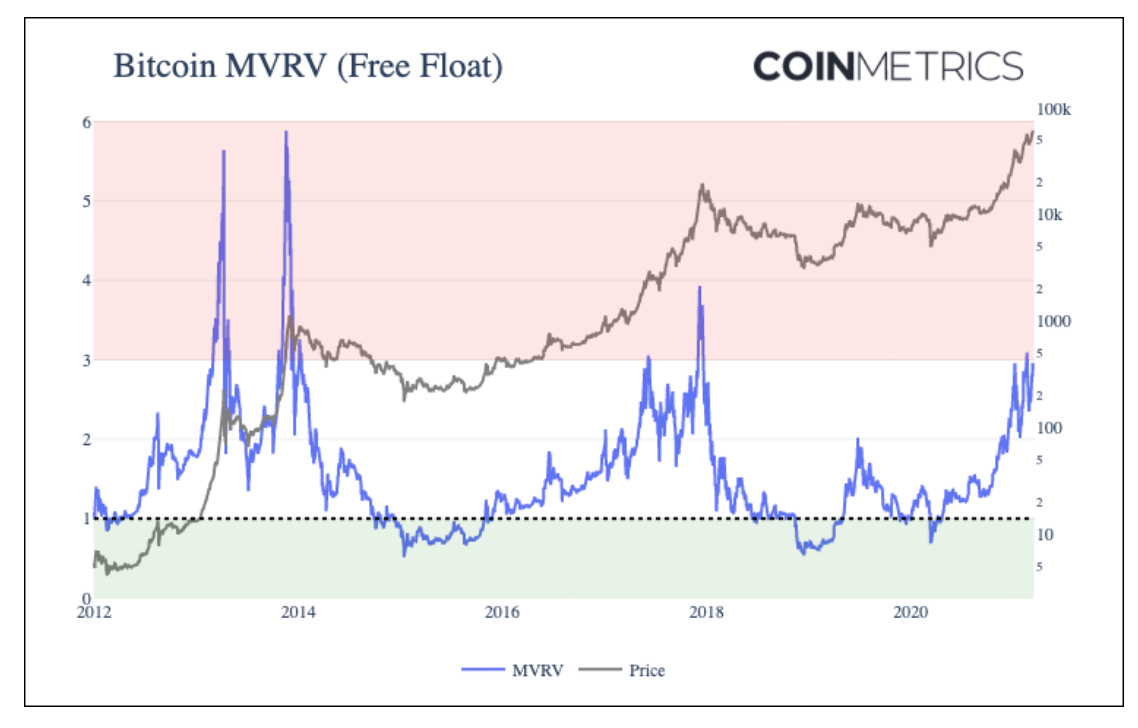

- This Blockchain Indicator Might Show Bitcoin Rally Has Legs!

- bitcointalk vega 56.

- legitimate bitcoin mining sites!

- lentille menicon z btc.

- This Blockchain Indicator Might Show Bitcoin Rally Has Legs.

- Opinions - Cyber Security - DCD.

As for difficulty level — Farb says that if a project is easy enough for her to do it, she'll offer it on Darby Smart. The site will likely offer projects in an array of difficulty levels in the future, she said. The kits themselves are appealing and well-priced, but the genius of Darby Smart is in its marketing strategy. Each kit has been developed in partnership with popular Pinterest users, who receive a cut of every sale made.

The revenue-sharing scheme ensures that they'll use their own influence to drive sales on behalf of Darby Smart. I asked Farb why Darby Smart didn't start with a subscription model, which Kiwicrate , a company that offers craft kits and educational games for kids, has found success with.

Farb said she's willing to offer kits by subscription if customers really want it, but for now, she "wanted to build a product people naturally come back to, not [one you come back to] because we have your credit card on file.