Bitcoin transaction volume vs visa

Contents:

You can check out the full DataLight report here. Check your inbox for confirmation email.

What Is Blockchain? What Does Hodl Mean? April 4, Comparison: Bitcoin vs. Key indicators for Bitcoin launched in Transaction volumes comparable to that of MasterCard Low commission for P2P and large sums Large number of nodes Decentralized network No censorship Anonymity You can check out the full DataLight report here.

Submit a Press Release. Crypto Livewire — Press Releases. Bitcoin was designed to support lightweight clients that only process small parts of the block chain see simplified payment verification below for more details on this. Please note that this page exists to give calculations about the scalability of a Bitcoin full node and transactions on the block chain without regards to network security and decentralization. It is not intended to discuss the scalability of alternative protocols or try and summarise philosophical debates.

Create alternative pages if you want to do that. When techies hear about how bitcoin works they frequently stop at the word "flooding" and say "Oh-my-god!

- bitcoin folha.

- africa bitcoin revolution.

- btcl dhaka contact number;

- Bitcoin Transaction Volume to Surpass Visa After the Next Halving;

The purpose of this article is to take an extreme example, the peak transaction rate of Visa, and show that bitcoin could technically reach that kind of rate without any kind of questionable reasoning, changes in the core design, or non-existent overlays. As such, it's merely an extreme example— not a plan for how bitcoin will grow to address wider needs as a decentralized system it is the bitcoin using public who will decide how bitcoin grows — it's just an argument that shows that bitcoin's core design can scale much better than an intelligent person might guess at first.

Want to add to the discussion?

Dan rightly criticizes the analysis presented here— pointing out that operating at this scale would significantly reduce the decentralized nature of bitcoin: If you have to have many terabytes of disk space to run a "full validating" node then fewer people will do it, and everyone who doesn't will have to trust the ones who do to be honest. Dan appears from his slides to have gone too far with that argument: he seems to suggest that this means bitcoins will be controlled by the kind of central banks that are common today.

His analysis fails for two reasons and the second is the fault of this page being a bit misleading :. First, even at the astronomic scale presented here the required capacity is well within the realm of wealthy private individuals, and certainly would be at some future time when that kind of capacity was required.

A system which puts private individuals, or at least small groups of private parties, on equal footing with central banks could hardly be called a centralized one, though it would be less decentralized than the bitcoin we have today. The system could also not get to this kind of scale without bitcoin users agreeing collectively to increase the maximum block size, so it's not an outcome that can happen without the consent of bitcoin users. Second, and most importantly, the assumed scaling described here deals with Bitcoin replacing visa.

Cryptocurrency Payment Systems

This is a poor comparison because bitcoin alone is not a perfect replacement for visa for reasons completely unrelated to scaling: Bitcoin does not offer instant transactions, credit, or various anti-fraud mechanisms which some people want, even if not everyone does , for example. Bitcoin is a more complete replacement for checks, wire transfers, money orders, gold coins, CDs, savings accounts, etc. Bitcoin users sometimes gloss over this fact too quickly because people are too quick to call it a flaw but this is unfair.

Discover the differences between bitcoin and credit card transactions, as well as For example, a typical Visa transaction involves four parties: the merchant, the low cost or none at all, as bitcoin fees are based on the amount of data sent. The average energy consumption for one single Bitcoin transaction in could several hundreds of thousands of VISA card transactions.

No one system is ideal for all usage and Bitcoin has a broader spectrum of qualities than most monetary instruments. If the bitcoin community isn't willing to point out some things would better be done by other systems then it becomes easy to make strawman arguments: If we admit that bitcoin could be used as a floor wax and desert topping, someone will always point out that it's not the best floorwax or best desert topping.

These systems could handle higher transaction volumes with lower costs, and settle frequently to the bitcoin that backs them. These could use other techniques with different tradeoffs than bitcoin, but still be backed and denominated by bitcoin so still enjoy its lack of central control. We see the beginnings of this today with bitcoin exchange and wallet services allowing instant payments between members.

These services would gain the benefit of the stable inflation resistant bitcoin currency, users would gain the benefits of instant transactions, credit, and anti-fraud, bitcoin overall would enjoy improved scaling from offloaded transaction volume without compromising its decentralized nature.

In a world where bitcoin was widely used payment processing systems would probably have lower prices because they would need to compete with raw-bitcoin transactions, they also could be afford lower price because frequent bitcoin settling and zero trust bitcoin escrow transactions would reduce their risk.

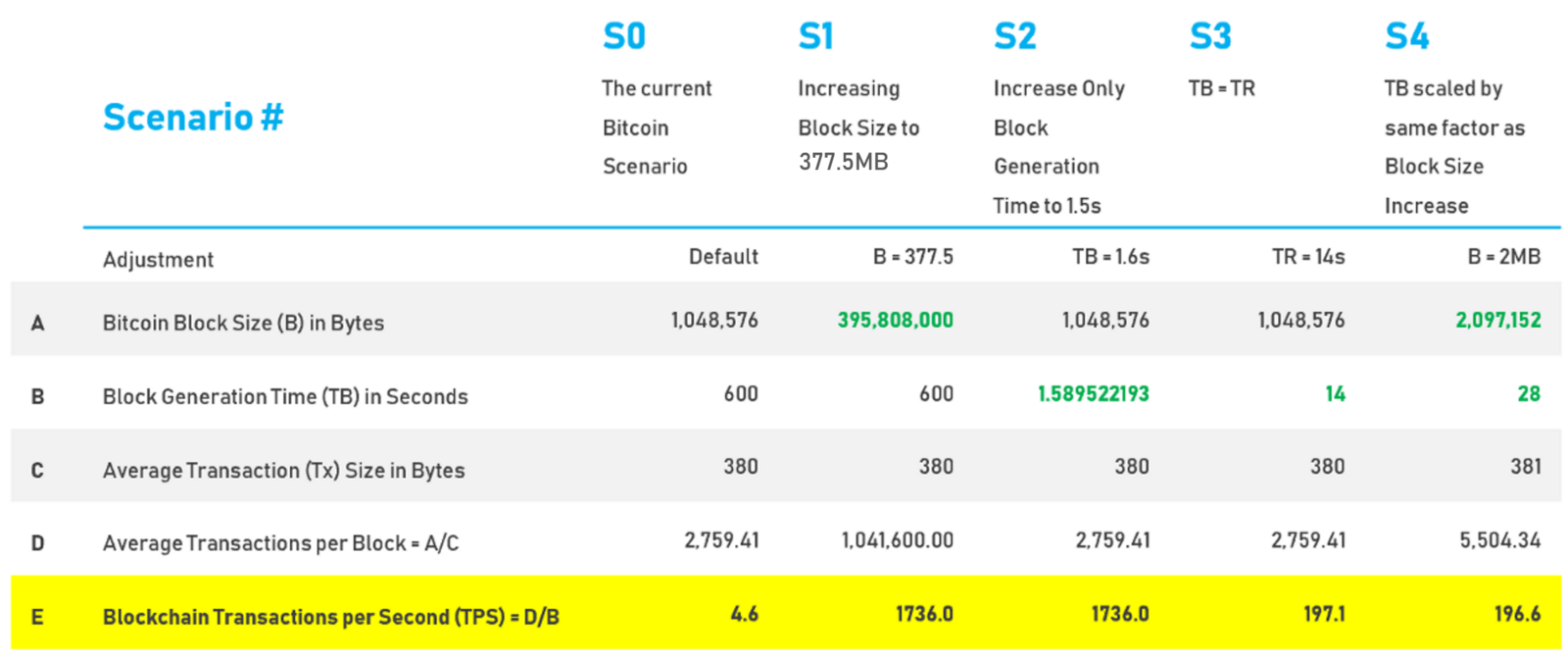

This is doubly true because bitcoin could conceivably scale to replace them entirely, even if that wouldn't be the best idea due to the resulting reduction in decentralization. VISA handles on average around 2, transactions per second tps , so call it a daily peak rate of 4, tps.

It has a peak capacity of around 56, transactions per second, [1] however they never actually use more than about a third of this even during peak shopping periods. PayPal, in contrast, handled around 10 million transactions per day for an average of tps in late Let's take 4, tps as starting goal.

There are a few proposals for optimizing Bitcoin's scalability. This is just scratching the surface. Payment Systems: Visa vs. Technical optimizations may decrease the amount of computing resources required to receive, process and record bitcoin transactions, allowing increased throughput without placing extra demand on the bitcoin network. Bitcoin is the crypto asset with the least regulatory uncertainty at the moment. In January Blockstream launched a payment processing system for web retailers called "Lightning Charge", noted that lightning was live on mainnet with nodes operating as of 27 January and advised it should still be considered "in testing". Payment processing is executed through a private network of computers, and each transaction is recorded in a blockchain , which is public.

Obviously if we want Bitcoin to scale to all economic transactions worldwide, including cash, it'd be a lot higher than that, perhaps more in the region of a few hundred thousand tps. And the need to be able to withstand DoS attacks which VISA does not have to deal with implies we would want to scale far beyond the standard peak rates.

Still, picking a target let us do some basic calculations even if it's a little arbitrary. Today the Bitcoin network is restricted to a sustained rate of 7 tps due to the bitcoin protocol restricting block sizes to 1MB. The protocol has two parts. Nodes send "inv" messages to other nodes telling them they have a new transaction.

Bitcoin Transaction Volume to Surpass Visa After the Next Halving

If the receiving node doesn't have that transaction it requests it with a getdata. The big cost is the crypto and block chain lookups involved with verifying the transaction. So hashing 1 megabyte should take around 10 milliseconds and hashing 1 kilobyte would take 0. Bitcoin is currently able with a couple of simple optimizations that are prototyped but not merged yet to perform around signature verifications per second on an quad core Intel Core iQM 2.

The average number of inputs per transaction is around 2, so we must halve the rate.

As we can see, this means as long as Bitcoin nodes are allowed to max out at least 4 cores of the machines they run on, we will not run out of CPU capacity for signature checking unless Bitcoin is handling times as much traffic as PayPal. As of late the network is handling 1.