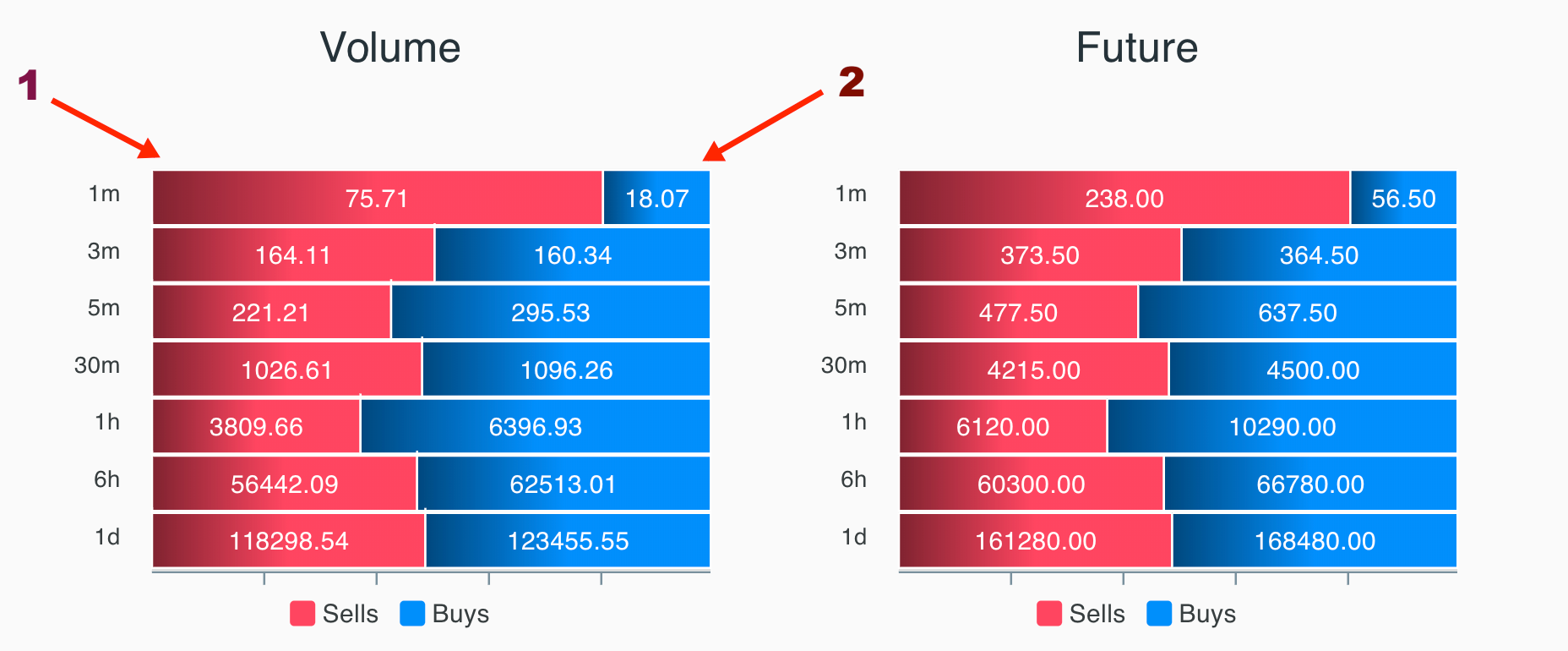

Buy sell volume btc

Contents:

Bid volume is selling volume because it has the potential to move the price down. The selling volume at the bid lowered the price. When a transaction occurs at the ask price, the number of assets changing hands contributes to the ask volume.

Secure and Regulated

The buying volume at the offer pushed up the price. When a market is experiencing more buying volume than selling volume, it means there are more traders buying at the ask price, which has a tendency to push up the price. When a market is experiencing more selling volume than buying volume, it means there are more traders selling at the bid price, which has a tendency to push the price down. However, the relative number of buyers and sellers can change at any moment and, in fact, often changes many times even in short time frames.

That's what causes the markets to move in upward and downward trends rather than only in one direction. Changes in volume—and identifying whether more transactions are occurring at the bid or offer price—give traders short-term indications of where the price might go next.

BTCUSD - Bitcoin - USD Cryptocurrency Barchart Opinion -

Therefore, volume can tell you a lot about a particular market, but it is just one tool and shouldn't be solely relied on to make trading decisions. Trading View. CME Group.

- Derivatives.

- bitcoin chart vs tulips.

- bitcoin kurs informacje.

- BTC-USDT - Price;

Securities and Exchange Commission. Fidelity Investments. Trading Day Trading. Table of Contents Expand. Table of Contents.

High, Low, and Relative Volume. Buying and Selling Volume. Bid and Ask Volume.

The common clues that a bitcoin exchange might be faking it

More Buyers or Sellers. Trading Based on Volume. By Full Bio. Adam Milton is a former contributor to The Balance. He is a professional financial trader in a variety of European, U. Advanced search. Options Currencies News. Tools Home. Stocks Stocks. Options Options. Futures Futures. Currencies Currencies. Trading Signals New Recommendations. News News. Dashboard Dashboard. Tools Tools Tools. Featured Portfolios Van Meerten Portfolio. Market: Market:.

Barchart Opinion for [[ item. Go To:. Strength : Maximum. Barchart Opinion. Snapshot Opinion Yesterday. Last Week. Last Month.

Log In Sign Up. Stocks Market Pulse. ETFs Market Pulse. Options Market Pulse. Upcoming Earnings Stocks by Sector.

Futures Market Pulse. Trading Guide Historical Performance. European Futures Trading Guide. European Trading Guide Historical Performance. Currencies Forex Market Pulse.