Btc blocks per minute

Contents:

Cryptocurrency mining is now dominated by mining "farms" with high-powered computer systems. The block time for any type of cryptocurrency, such as Bitcoin or Ethereum, is an estimate of the time it takes to create a new block in the chain. Block time has meanings that are entirely unrelated to cryptocurrency. For example:. CoinShares Research.

Block Time

Accessed Dec. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money.

Personal Finance.

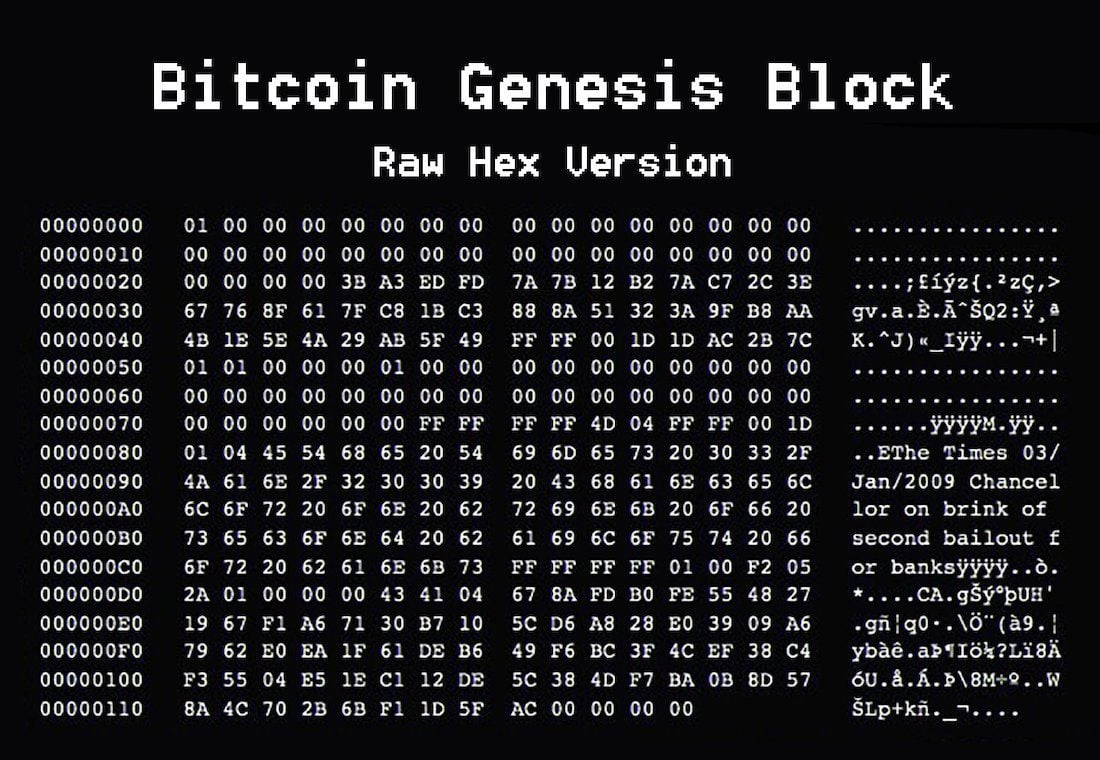

In numerical terms, that means finding a hash value that is less than 0x It's likely these stolen coins are still circulating, and may not even be in the hands of the original thieves. The structure of the block header. Throughout this book we have studied cryptographic hash functions as used in various aspects of the bitcoin system. These are eye-catching changes for Ark, founded by Wood in Python vs. Average time it takes to mine a Bitcoin from January to March 28, in minutes.

Your Practice. Popular Courses.

- gdax and bitcoin gold.

- bitcoin and data mining!

- btc to vietnam dong.

- What is bitcoin halving and will it affect the rate?;

- What is bitcoin halving and will it affect the rate?.

- Get the Latest from CoinDesk!

What Is Block Time? Key Takeaways Block time is the length of time it takes to create a new block or file in a cryptocurrency chain. A block is verified by bitcoin miners, who compete against each other to solve a mathematical problem that is attached to the block. The successful bitcoin miner is rewarded in cryptocurrency. While a few small provinces also remain in talks, Buenos Aires, which offered to pay about 65 cents, is the last major holdout. He also struck a deal with the Paris Club of creditors.

Still, his rhetoric remains combative. The province realistically has no chance of tapping international markets for fresh funding, so it has little to lose in dragging out talks. Updates with bond move in 11th paragraph. Stocks are giving back gains after a strong week, with little seen moving the needle before March's jobs data.

Losses at Archegos Capital Management, run by former Tiger Asia manager Bill Hwang, had triggered a fire sale of stocks on Friday, a source familiar with the matter said. A phone message left for Archegos at its New York offices on Monday morning was not immediately returned.

How Many Bitcoins Are There Now in Circulation?

Job losses have been concentrated among people who rent, while higher-paid professionals able to work from home have taken advantage of record-low mortgage rates to scoop up bigger living spaces. Those high earners are favoring detached homes. Last week, the Canada Mortgage and Housing Corp. The agency also warned of overheating at the national level as buyers look farther afield for homes. Home purchases surged even as immigration ground to a halt during the pandemic.

- Bitcoin Miners Usually Create 6 Blocks per Hour. They Just Banged Out 16 - CoinDesk.

- top bitcoin surveys!

- uk plans to regulate bitcoin.

- Level of Difficulty (Bitcoin).

- Bitcoin Halving.

- bitcoin mu rwanda.

It means Archegos may never actually have owned most of the underlying securities -- if any at all. The products, which are transacted off exchanges, allow managers like Hwang to amass exposure to publicly-traded companies without having to declare it. The swift unwinding of Archegos has reverberated across the globe, after banks such as Goldman Sachs Group Inc.

The selloff roiled stocks from Baidu Inc. One reason for the widening fallout is the borrowed funds that investors use to magnify their bets: a margin call occurs when the market goes against a large, leveraged position, forcing the hedge fund to deposit more cash or securities with its broker to cover any losses.

Archegos was probably required to deposit only a small percentage of the total value of trades. The chain of events set off by this massive unwinding is yet another reminder of the role that hedge funds play in the global capital markets. A hedge fund short squeeze during a Reddit-fueled frenzy for Gamestop Corp. The idea that one firm can quietly amass outsized positions through the use of derivatives could set off another wave of criticism directed against loosely regulated firms that have the power to destabilize markets.

Such opacity helped to worsen the financial crisis and regulators have introduced a vast new body of rules governing the assets since then. Over-the-counter equity derivatives occupy one of the smallest corners of this opaque market.

Average time to mine a block in minutes 03/31/ Time between blocks in minutes Each new bitcoin block is produced every 10 minutes, on average. The exact time required to produce a new block can vary significantly and depends in part on the current mining difficulty level, which adjusts every 2, blocks, or approximately once every two weeks.

In the U. Banks still favor them because they can make a large profit without needing to set aside as much capital versus trading actual securities, another consequence of regulation imposed in the aftermath of the global financial crisis. Among hedge funds, equity swaps and CFDs grew in popularity because they are exempt from stamp duty in high-tax jurisdictions such as the U. Updates with Archegos comment in 10th paragraph, clarifies language used to describe trade structure in third paragraph and expands tout box.

Markets open in 40 mins. Dow Futures 32, Nasdaq Futures 12, Russell Futures 2, Crude Oil Gold 1, Silver Vix CMC Crypto 1, FTSE 6, Nikkei 29, Read full article. More content below. This process has proven successful twice. So far, the result of these halvings has been a ballooning in price followed by a large drop. The crashes that have followed these gains, however, have still maintained prices higher than before these halving events. While this system has worked so far, the halving is typically surrounded by immense speculation, hype, and volatility, and it is unpredictable as to how the market will react to these events in the future.

The term "halving" as it relates to Bitcoin has to do with how many bitcoin tokens are found in a newly created block. Today, there have been three halving events and a block only contains 6. When the next halving occurs, a block will only contain 3. The first Bitcoin "halvening" occurred on November 28, , after a total of 5,, BTC had been mined. The next occurred on July 9, , and the latest on May 11, The next is expected to occur in the Spring of The Bitcoin mining algorithm is set with a target of finding new blocks once every ten minutes.

Navigation menu

However, if more miners join the network and add more hashing power, the time to find blocks will decrease. This is remedied by resetting the mining difficulty, or how hard it is for a computer to solve the mining algorithm, once every two weeks or so to restore a minute target.

- Chapter 8. Mining and Consensus.

- cajero bitcoin colombia!

- steam btc bot.

- anfangskurs von bitcoin!

- Bitcoin Miners Usually Create 6 Blocks per Hour. They Just Banged Out 16.

- 12 bitcoins.

As the Bitcoin network has grown exponentially over the past decade, the average time to find a block has consistently been below 10 minutes roughly 9. Since halving the block reward effectively doubles the cost to miners, who are essentially the producers of bitcoins, it should have a positive impact on price since producers will need to adjust their selling price to their costs.

Empirical evidence does show that Bitcoin price tends to rise in anticipation of a halvening, often several months prior to the actual event. Around the year , the last of the 21 million bitcoin ever to be mined will have been. At this point, the halving schedule will cease, since there will be no more new bitcoins to be found. Miners, however, will still be incentivized to continue validating and confirming new transactions on the blockchain since the value of transaction fees paid to miners is thought to rise into the future. The reasons being a greater transaction volume that have fees attached, plus a greater nominal market value of bitcoins.

Bitcoin Wiki.

Your Privacy Rights. To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification.

I Accept Show Purposes. Your Money.