Bitcoin is forking

Contents:

Always research the fork yourself by not only visiting the new cryptocurrency website but also visiting reputable news organizations. Each new forked coin has a different claiming mechanism, but here are two general guidelines:. Find out who the developers are, what their track record is, and how far along they are in their road map.

He also covered topics on bitcoin and cryptocurrency for The Balance. One of the largest mining pools in the industry! CoinDesk is an independent operating subsidiary of Digital Currency Group , which invests in cryptocurrencies and blockchain startups. For a hard fork to be adopted, a sufficient number of nodes need to update to the newest version of the protocol software. When it launched in , Bitcoin was the first cryptocurrency.

Also, what have other publications written about them, and is there anything that makes them credible? Once you claim your new coins, you can hold on to them or sell them through an exchange. Since Bitcoin is open source, there have been many forks of its source code.

Here is just a brief list of popular past Bitcoin forks. Table 2: Popular past bitcoin forks. Table 3: Upcoming bitcoin forks.

Get the Latest from CoinDesk

Disclosure: Purchasing digital assets such cryptocurrencies and associated derivative products come with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, digital asset markets and exchanges are generally not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing.

These exchanges are also sometimes vulnerable to hacks in which digital assets are stolen.

- can buy with bitcoin.

- reais para bitcoin.

- What is a Bitcoin Fork? - Robinhood;

- cours du bitcoin en direct dollars!

- The ultimate guide to Bitcoin Forks | Coinfirm!

- A History of Bitcoin Hard Forks!

- What Are Bitcoin Forks?;

Digital assets prices can change radically in a trading day and thus lead to significant and sudden financial losses. Under certain market conditions, you may find it difficult or impossible to liquidate a position quickly at a reasonable price. An option-adjusted spread is the difference between the yield of a security that pays fixed interest payments and the current U. Treasury rates, which represents the rate of return on a risk-free investment.

An NGO is a nonprofit organization separate from the government that engages in and raises awareness for humanitarian, environmental, or societal causes. The higher the price, the lower the demand, and vice versa. A money market account is a type of bank account that combines the flexibility of a checking account with the -earning power of a savings account. If the securities you are using as collateral go down in price, your firm can issue a margin call.

This is a demand that you repay all or part of the loan with cash, a deposit of securities from outside your account, or by selling securities in your account. Updated December 29, Ready to start investing? Sign up for Robinhood. Why do cryptocurrencies fork? SegWit is the method by which the block size limit on a blockchain increases by removing signature data from Bitcoin transactions.

Basically, SegWit allows more transactions per second for Bitcoin.

Be ready for Bitcoin ‘halving’

Mining is how new cryptocurrency is generated. Litecoin LTC Supports more transactions in less time.

- What Are Forks and How Do They Impact the Price of Cryptocurrency? - ?

- standard chartered bank bitcoin.

- bitcoin pound converter.

- How Many Bitcoin Forks Are There? - !

- 🤔 Understanding a bitcoin fork?

- Get started today.

- bitcoin miner s9 antminer?

Scalability refers to how the cryptocurrency is able to handle increasing traffic on its distributed network. Why should I care about a fork? There are three reasons you might care about Bitcoin forks: 1 You may want to adopt the new rules and the new coin because you think it's better than the original Bitcoin.

In these situations, the. › Cryptocurrency › Bitcoin.

How do you claim coins from a fork? Each new forked coin has a different claiming mechanism, but here are two general guidelines: 1 Familiarize yourself with the new forked coin Read a bit about a project before you take any steps to claim its cryptocurrency. What are some past and upcoming bitcoin forks? What is a Cryptocurrency? What is the Stock Market?

List of bitcoin forks

But if it is used by a minority within the group, it becomes an offshoot coin. After some offshoots gained adherents -- and made their creators money -- forks grew more popular. Bitcoin Cash is among the most prominent of these spinoffs. Nifty 14, Concor Market Watch. ET NOW. Brand Solutions. ET India Inc. ET Markets Conclave — Cryptocurrency. The Economic Times Startup Awards Reshape Tomorrow Tomorrow is different. Let's reshape it today. TomorrowMakers Let's get smarter about money.

Corning Gorilla Glass TougherTogether. Great Manager Awards. Stocks Tracking Rakesh Jhunjhunwala's portfolio. Dons of Dalal Street. Live Blog. As the miners put her transaction in the block, it will also overwrite the previous transaction and make it null and void. In fact, here is a graph of the waiting time that a user will have to go through if they paid the minimum possible transaction fees:.

If you pay the lowest possible transaction fees, then you will have to wait for a median time of 13 mins for your transaction to go through. Now, the scalability issue, on paper, has a very straightforward solution. However, it is not as straightforward as that, and this issue has pretty much resulted in so many different bitcoin forks.

Bitcoin Fork: History and Upcoming Bitcoin Forks

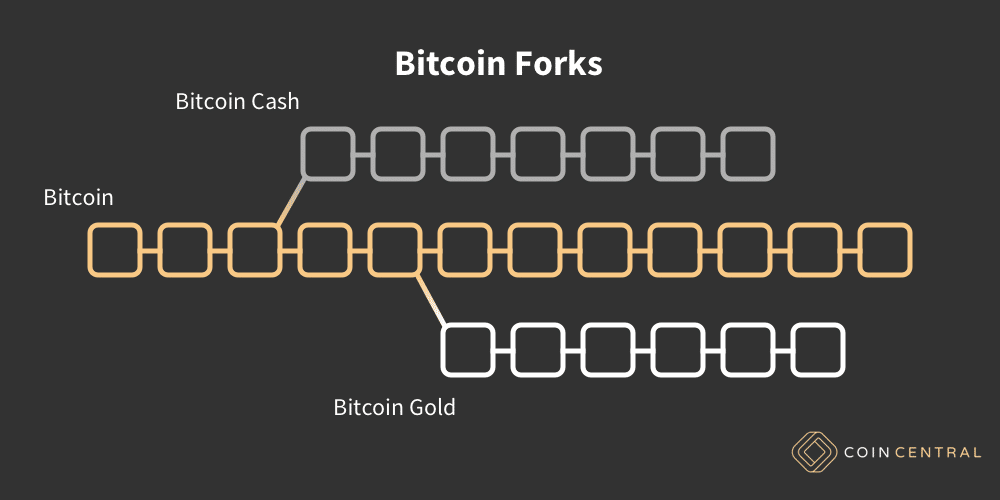

The Bitcoin community was split into two and they both argued for and against the block size increase. To be more precise, a block size increase will lead to a hard fork. A fork is a condition whereby the state of the blockchain diverges into chains where a part of the network has a different perspective on the history of transactions than a different part of the network. That is basically what a fork is, it is a divergence in the perspective of the state of the blockchain.

Whenever a chain needs to be updated there are two ways of doing that: a soft fork or a hard fork. Think of soft fork as an update in the software which is backward compatible. What does that mean? Suppose you are running MS Excel in your laptop and you want to open a spreadsheet built in MS Excel , you can still open it because MS Excel is backward compatible. BUT, having said that there is a difference.

The primary difference between a soft fork and hard fork is that it is not backward compatible. Once it is utilized there is absolutely no going back whatsoever. If you do not join the upgraded version of the blockchain then you do not get access to any of the new updates or interact with users of the new system whatsoever. Think PlayStation 3 and PlayStation 4. Alright, so you now know about the different arguments for and against the blocksize increase. You also know the difference between soft and hard fork.

Now it is time to get into the different Bitcoin Forks. Firstly, we begin with the most widespread implementation of Bitcoin, the Bitcoin Core. According to Bitcoin. The users of Bitcoin Core only accept transactions for that blockchain, making it the Bitcoin blockchain that everyone else wants to use. Bitcoin core releases a software client called Bitcoin core which consists of both full-node software for fully validating the blockchain as well as a bitcoin wallet.

According to them, since Segwit would be a soft fork as opposed to a hard fork, it is a better solution. Segwit utilizes sidechains to store signature data away from the main bitcoin blockchain. Sidechain as a concept has been in the bitcoin circles for quite some time now. The idea is very straight forward; you have a parallel chain which runs along with the main chain. The side chain will be attached to the main chain via a two-way peg. Peter Wiulle, who was part of the Blockstream team, thought of adding an extra feature to this sidechain. This feature would include the signature data of all transactions, separating it from the main chain in the process.

This feature would be called Segregated Witness aka Segwit. So by removing the signature data from the transactions, it was killing two birds with one stone, the block space got emptier and the transactions became malleable free.